Global Health and Wellness Product Market Assessment: Analysis by Segment and Regional Forecast to 2035

Overview:

The global health and wellness product sector reached a valuation of USD 7,235 million in 2024. The market is anticipated to expand to USD 7,792 million in 2025. Projections indicate a significant growth trajectory through 2035, with a projected compound annual growth rate (CAGR) of 8.2%, driving the market value to an estimated USD 17,119 million.

Rising international interest in preventive health measures and managing lifestyle diseases is a primary catalyst for demand. Consumers are increasingly seeking solutions for nutrition, immune system support, and mental wellbeing, driving strong demand for functional foods, dietary supplements, and natural personal care items.

Key industry players such as Nestlé Health Science, Danone, and Amway are leading the way with innovations in personalized nutrition and clean-label wellness offerings. The market is becoming more diverse, presenting products from probiotic-enriched beverages to plant-based proteins designed to support various health goals, from weight management to enhancing immunity, gut health, and stress reduction.

Furthermore, technological tools like wearable devices and health applications are encouraging consumers to monitor and adapt their health behaviors, significantly boosting demand for digital health-related goods. Businesses that integrate data-driven customization with ethical sourcing and eco-friendly practices are particularly resonating with younger clientele, including millennials and Gen Z.

Overall, the health and wellness market is poised for robust expansion, influenced by changing lifestyles, digital advancements, and increased environmental awareness.

| Attributes | Description |

|---|---|

| Estimated Size (2025) | USD 7,792.1 million |

| Projected Value (2035) | USD 17,119.2 million |

| Value-based CAGR (2025 to 2035) | 8.2% |

The concept of health and wellness has evolved from focusing solely on reactive care to embracing proactive, daily routines. Products offering immune support, organic body care, and mindfulness practices have become increasingly popular. Brands like Garden of Life and Herbalife Nutrition emphasize non-GMO, organic, and sustainably certified components, which appeals to environmentally conscious consumers and fuels continued market expansion.

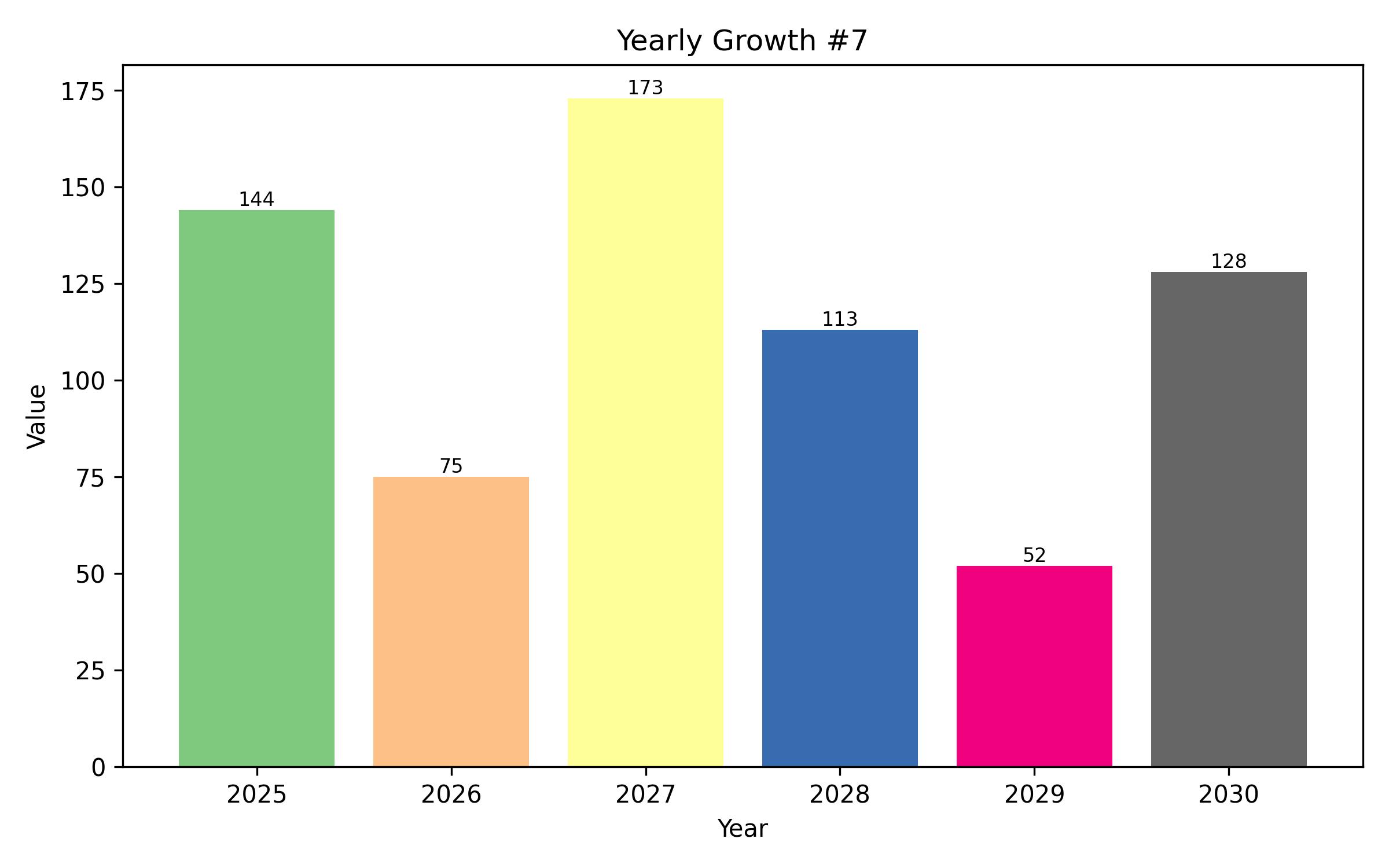

A comparative analysis of the CAGR across different periods reveals significant market performance shifts. From 2024 to 2034, the market exhibited a CAGR of 7.4% in the first half and 7.7% in the second half. Looking ahead to the 2025 to 2035 period, the projected CAGR rises to 8.0% in the first half and 8.2% in the second half, indicating accelerated growth. Over the recent period, the market saw a 60 basis point increase in the first half and a 20 basis point decrease in the second half compared to previous years.

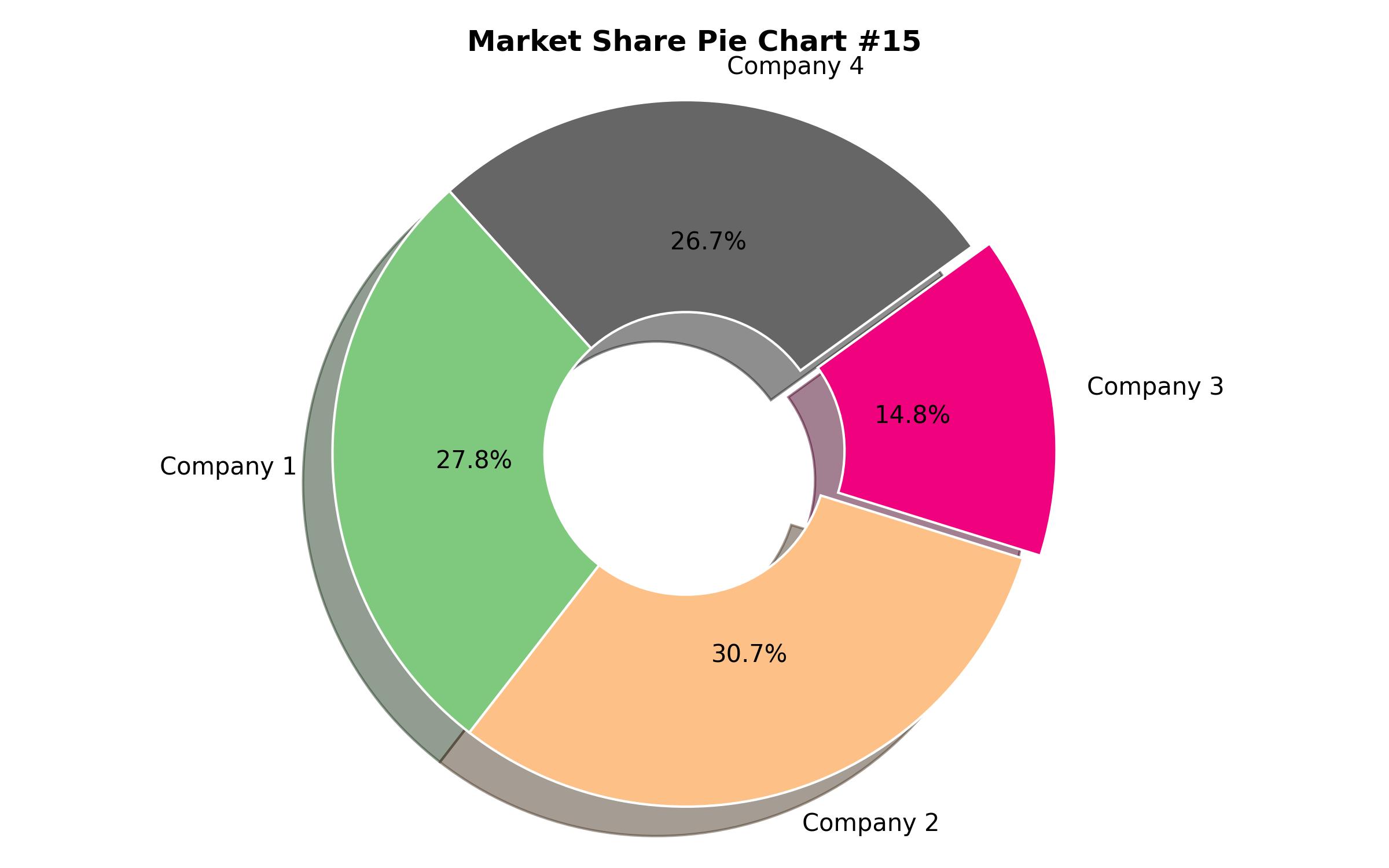

Market concentration is observable among companies specializing in diverse wellness categories including nutraceuticals, functional foods, personal care, and fitness products. These firms invest substantially in research and development, health-focused marketing strategies, and strategic acquisitions to maintain a competitive edge. Nestlé Health Science exemplifies this by expanding its portfolio to include medical nutrition, supplements, and functional beverages, leveraging its global reach and reputation in nutritional science.

Similarly, Unilever’s Vitality and Wellbeing division has entered the market with plant-based nutrition, vitamins, and natural personal care products, benefiting from the company’s sustainability image. Procter & Gamble is another significant force with brands like Metamucil and Align, focusing on digestive health and utilizing a widespread distribution network for visibility. These major corporations set market trends, influence consumer perceptions, and hold significant presence across various product categories and geographical areas.

Mid-sized companies constitute a vital part of the market, typically holding strong regional presences or dominating specific niches such as dietary supplements, organic foods, fitness goods, and clean-label personal care items. Brands like Garden of Life and The Honest Company have cultivated strong customer loyalty through their commitment to ingredient integrity, sustainability practices, and effective product formulations.

NOW Foods competes effectively by prioritizing product quality and maintaining extensive distribution networks spanning retail and e-commerce channels. These companies differentiate themselves through strong brand identities linked to wellness lifestyles, targeted product offerings, and customer engagement initiatives, often focusing on natural and premium products.

Emerging tier 3 brands consist of startups and smaller enterprises catering to highly specific wellness needs with organic, vegan, adaptogenic, or customized health products. These businesses often rely on limited distribution models, direct-to-consumer sales, social media promotion, and local health food stores.

Examples include Ritual, which offers subscription-based supplements, and Moon Juice, known for its adaptogenic blends, appealing to the wellness preferences of millennials and Gen Z. Their ability to quickly adapt to emerging trends, emphasize clean ingredients, and build community-oriented brands enables rapid expansion despite the limitations of their scale on profit margins.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 7,792.1 million |

| Revenue Forecast for 2035 | USD 17,119.2 million |

| Growth Rate (CAGR) | 8.2% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019-2024 |

| Forecast Period | 2025-2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Product Category, Sales Channel, Function, Product Type, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | USA, Germany, China, Japan, India, UK, France, Brazil, UAE, Saudi Arabia, South Africa |

| Key Companies Analyzed | Pfizer Inc., PROVANT HEALTH SOLUTIONS INC., Nestle, The Kraft Heinz Company, Arbonne International, Buy Wellness, GSK, Walgreens Co., Procter & Gamble, General Nutrition Centers Inc. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Product Category

- Functional Foods

- Dietary Supplements

- Personal Care Products

- Fitness Products

- By Sales or Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Retail

- Pharmacies

- By Function

- Nutritional Support

- Immunity Boosting

- Digestive Health

- Stress and Mental Wellness

- By Product Type

- Vitamins and Minerals

- Herbal Supplements

- Probiotics

- Protein Supplements

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Table of Content

- Executive Summary

- Market Overview

- Key Trends Shaping the Market

- Semi-Annual Market Update

- Market Concentration Analysis

- Trends in Health and Wellness Product Demand

- Country-wise Insights

- USA Market Performance

- Germany Market Dynamics

- China Market Expansion

- Japan Market Overview

- India Market Outlook

- Category-Wise Insights

- Beverages and Packaged Food Segment Analysis

- Supermarkets and Hypermarkets Distribution Channel

- Competitive Landscape

- Leading Companies and Market Share Analysis

- Company Profiles

- Regulatory Environment

- Market Challenges and Opportunities

- Future Market Projections

- Research Methodology

- Sources and Assumptions