Global Wine Barrel Market Assessment by Primary Wood Varieties (French Oak, American Oak, Eastern European Oak) and Other Types, Projected to 2035

Overview:

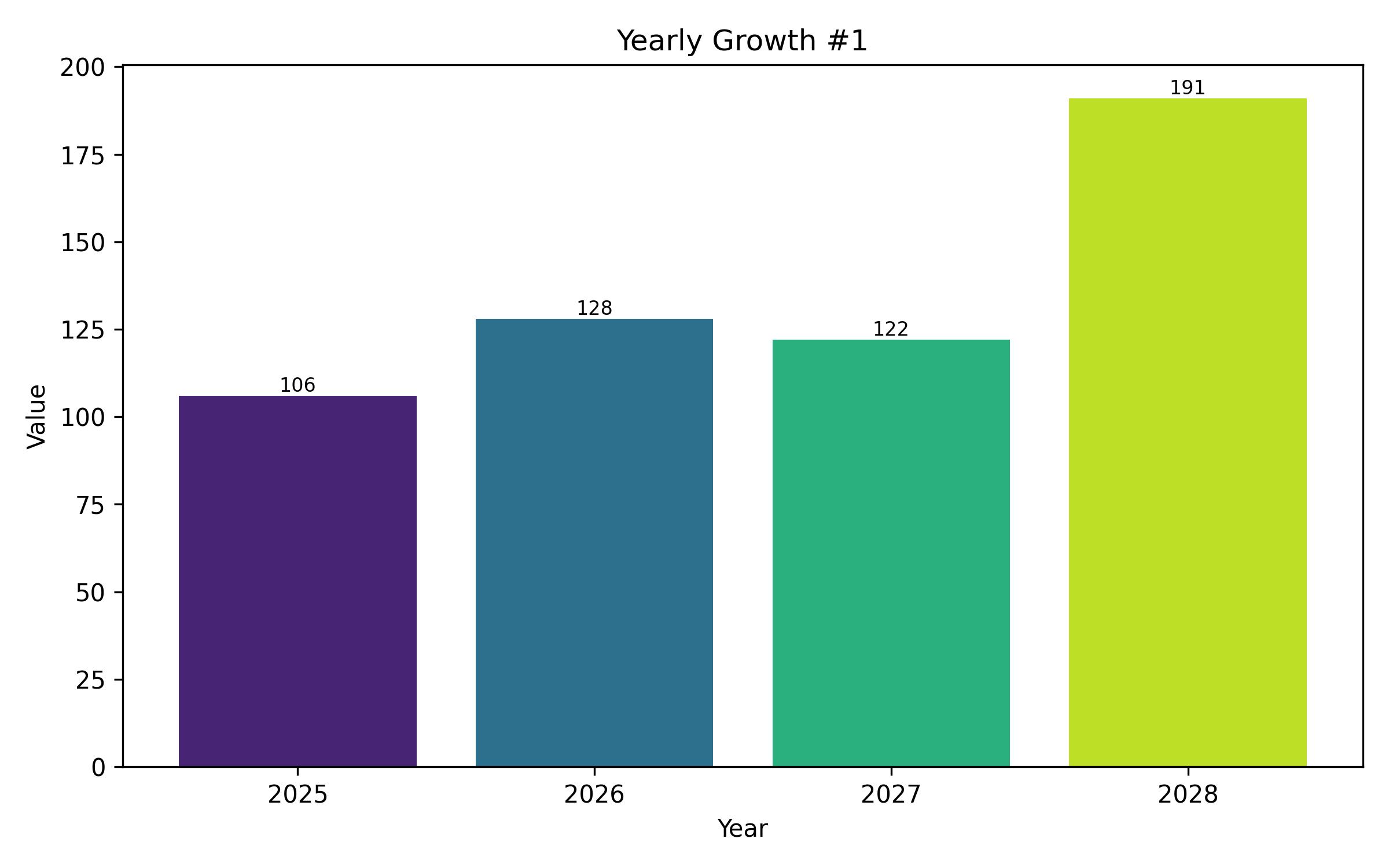

The global market for wine barrels reached an estimated USD 4.3 billion in 2024 and is projected to grow to USD 4.5 billion by 2025. Anticipating further expansion, the market is forecast to achieve USD 6.7 billion by 2035, demonstrating a steady compound annual growth rate (CAGR) of 4.4% from 2025 through 2035.

Demand for premium and aged wines is a primary catalyst for the wine barrel market. Oak barrels are particularly valued for their ability to significantly enhance the texture, flavor, and overall quality of wine. The increasing global consumer preference for high-quality alcoholic beverages is encouraging wineries to invest in superior oak barrels and barrels made from specialized woods.

A growing focus on sustainable winemaking practices is also influencing the market. Wineries are increasingly adopting environmentally friendly approaches, such as reusing barrels or parts, which supports the demand for eco-conscious barrel production. Many winemakers view traditional barrel aging as an essential method for producing quality wines.

Barrel manufacturing technology is continually evolving, contributing to market growth. Vintners are exploring various wood types, toasting levels, and aging durations to craft wines with unique characteristics. This exploration has led to the availability of French oak, American oak, and other wood barrels with distinct flavor profiles and textures. The rising popularity of organic and biodynamic wines further necessitates the use of natural and clean wood barrels.

Regionally, Europe holds the largest share of the wine barrel market, driven by its historical and prominent wine-producing nations, including France, Italy, and Spain. North America, particularly the United States, is experiencing notable growth in its wine sector. Emerging markets in South America, Australia, and the Asia-Pacific are also expected to contribute significantly to future expansion, fueled by increasing wine production and consumption.

| Particulars | Details |

|---|---|

| Estimated Global Wine Barrel Industry Size (2025E) | USD 4.5 billion |

| Projected Global Wine Barrel Industry Value (2035F) | USD 6.7 billion |

| Value-based CAGR (2025 to 2035) | 4.4% |

Despite positive trends, the market faces challenges such as the high cost of premium barrels, potential price volatility of raw materials, and extended production lead times. Nevertheless, industry initiatives focused on sustainable forest management and innovative cooperage practices are expected to mitigate these challenges and support stable growth over the coming years.

Semi-Annual Market Update

The following table presents a comparative analysis of the half-yearly value CAGRs for the world wine barrel market, comparing the base year (2024) with the specified year (2025). This data helps stakeholders understand performance trends and revenue dynamics, facilitating more accurate market forecasting.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.0% |

| H2 (2024 to 2034) | 4.2% |

| H1 (2025 to 2035) | 4.3% |

| H2 (2025 to 2035) | 4.4% |

During the first half (H1) of the 2025 to 2035 decade, the market is projected to grow at a 4.3% CAGR, increasing to 4.4% in the second half (H2). Compared to the previous decade, the market is showing slightly accelerated growth, with a 30 basis point (BPS) increase in H1 and a 20 BPS increase in H2. This indicates a steady momentum. Wine barrel manufacturers are responding to the long-term demand for sophisticated, high-quality wines and the emphasis on sustainable winemaking through technological advancements in cooperage.

While the availability and cost of raw materials pose potential limitations, continuous innovation in barrel-making techniques and the expanding global appreciation for wine are expected to maintain consistent demand for quality wood products. The growth of the wine industry in new geographical areas and technological progress in aging processes will continue to fuel market expansion over the next three years.

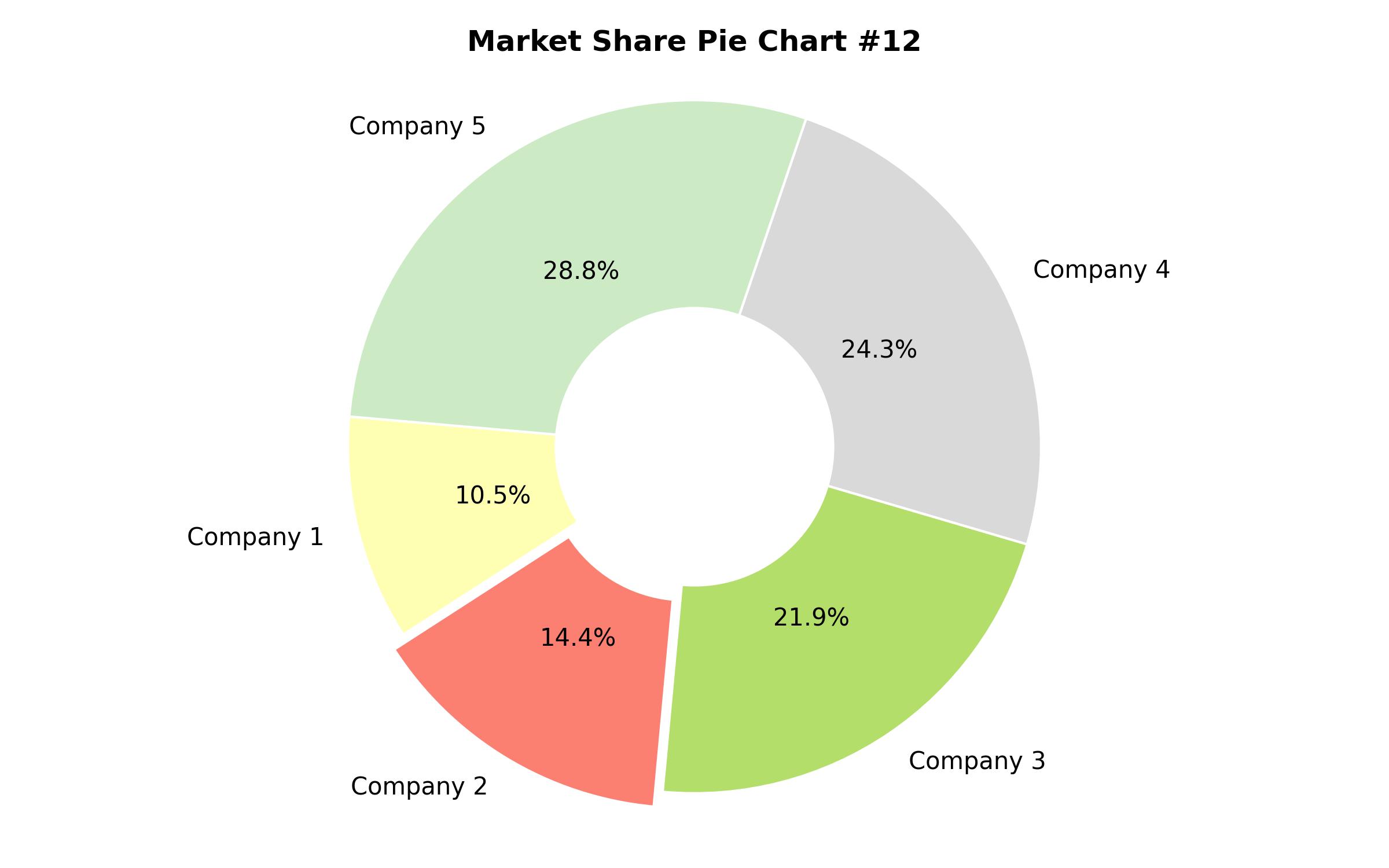

Market Concentration

The market is characterized by a tiered structure. Tier 1 companies are leaders with substantial revenue, significant market reach, and strong brand recognition. These firms invest heavily in product development and innovation. For instance, Tonnellerie Baron, a traditional French cooperage, is renowned for producing high-quality French oak barrels that combine heritage with modern technology. They sourced premium French oak from the best forests and reportedly supplied over 100,000 barrels annually before 2024 to leading global wineries. Seguin Moreau Napa Cooperage, part of the Oeneo Group, is another key player offering a range of products including barrels and accessories like silicone bungs and glass thieves.

These dominant companies achieve market leadership through large-scale production, strategic collaborations like joint ventures, and ongoing innovation to meet evolving consumer preferences. Tier 2 companies have considerable market presence but generate lower revenue compared to Tier 1 firms. An example is The Oak Cooperage in Missouri, established in 1973, which hand-crafts American oak barrels for producers of whiskey, wine, and bourbon. They supply prominent wineries such as Silver Oak in California.

Adirondack Barrel Cooperage is another notable Tier 2 company specializing in premium American White Oak barrels for aging various spirits including whiskey, wine, and brandy. These companies strategically target specific niches and premium segments, emphasizing differentiation to cater to demand for specialized flavors and aging processes. Their focus on product innovation and expanding geographic reach helps them strengthen their market position. Tier 3 consists of newer, emerging businesses entering the wine barrel market.

These players typically have limited distribution networks but are leveraging new operational models, including virtual and local channels, to drive rapid growth. Skolnik Industries, a leading stainless steel producer, offers a range of stainless steel wine barrels with standard and seamless designs in multiple sizes. Squarrel Barrels gained popularity with its unique square barrel design, offering aging characteristics comparable to traditional barrels with certain advantages. These emerging brands often focus on direct-to-consumer and social selling channels to compete, emphasizing unique designs, sustainability, and catering to specific aging requirements.

Understanding Shift in Wine Barrel Market Trends and How Key Brands Are Addressing It

Growing Demand for High-Quality, Aged Wine

Shift: Increased global demand for wines with enhanced aroma and flavor profiles necessitates greater investment by wineries in oak barrels, particularly from major wine consumption regions like Europe, North America, and Australia.

Strategic Response: To address this, Tonnellerie François Frères (France) developed high-toast French oak barrels tailored for aging Bordeaux and Burgundy wines. Seguin Moreau (France) introduced single-barrel aging programs allowing wineries to customize flavor extraction. Nadalie USA increased its production capacity, particularly benefiting American wineries, leading to a reported 9% utilization increase.

Increased Use of Alternative Woods in Barrels

Shift: While oak remains the standard, wineries are using hybrid barrels (oak inserts in stainless steel) and other woods (acacia, cherry, chestnut) for differentiated flavors, prominent in regions like California, Italy, and Spain. Strategic Response: World Cooperage (USA) created oak stave infusion systems, offering aging benefits at a lower cost than full barrels. Canton Cooperage (USA) produced charred cherry wood barrels for craft winemakers. Marchive (France) introduced acacia barrels, appreciated for imparting floral and honey notes and gaining about 6% market acceptance among European wineries.

Expansion of Mature Spirits and Craft Beverages Sector

Shift: The growth in aged spirits like whiskey, rum, and tequila, along with specialty beers, is increasing demand for used wine barrels for finishing, particularly in Scotland and North America where producers use recycled wine barrels. Strategic Response: Buffalo Trace Distillery (USA) released bourbon aged in ex-red wine barrels, resulting in a reported 12% increase in quality whiskey sales. Diageo (UK) maximized the use of Sherry casks for Scotch aging, boosting global Scotch sales. Goose Island Brewery (USA) aged stout in old French wine casks, enhancing its texture and quality, leading to an approximate 8% increase in craft beer sales.

Growth in Direct-to-Consumer Barrel Sales and Retail Conversion

Shift: The rise of home winemaking and boutique wine consumption is driving demand for smaller capacity barrels (10-30 gallons) available direct-to-consumer and in retail. This trend is most notable in the United States, Australia, and South Africa among serious amateur winemakers. Strategic Response: The Barrel Mill (USA) saw a 15% increase in sales of small oak barrels through their online store. Kelvin Cooperage (Scotland) launched a barrel subscription service for winemakers. E-commerce platforms like Amazon and specialty retailers reported approximately 19% higher wine barrel sales, including e-commerce barrels, in 2024.

Trend Towards Sustainability and Eco-Friendly Barrel Making

Shift: Cooperages and wineries are adopting sustainable forest practices, reducing carbon footprints, and minimizing waste. Concepts like ‘carbon-neutral cooperages’, ‘recycled oak barrelling’, and ‘FSC-certified wood’ are gaining traction, especially in North America and Europe. Strategic Response: Radoux Cooperage (France) introduced ‘green’ French oak barrels, which are about 10% more expensive but align with sustainable winery partners. G & P Cask Company (USA) implemented cask recycling programs, reportedly reducing waste by 15%. Tonnellerie de Mercury (France) established a carbon-zero factory, driven by bulk purchases from organic and biodynamic wineries.

Strategic Pricing to Enhance Wine Affordability

Shift: To meet demand for more economically priced barrels, producers are developing lower-cost options and secondary markets, especially important in emerging wine regions like Argentina, Chile, and South Africa. Tactical Responses: Vicard Cooperage (France) launched an economical barrel line, helping boutique wineries reduce costs by about 12%. Secondary markets in regions like Napa Valley saw previously used barrels available at discounts up to 30%, accessible to smaller winemakers. Australian Wine Barrels (Australia) introduced reconditioned barrel programs, positively impacting the used barrel market by around 7%.

Leveraging E-Commerce and Subscription Models

Shift: Online sales of wine barrels are accelerating, with wineries and cooperages utilizing direct web sales and barrel rental options. This is particularly prevalent in Europe, North America, and Asia-Pacific. Strategic Response: To capitalize on this trend, Seguin Moreau (France) implemented a barrel leasing program, leading to a reported 14% higher utilization rate. E-commerce sites like eBay and Alibaba also saw increased sales of second-hand barrels, with e-sales in other countries rising by 21%. Barrel Builders (USA) initiated a barrel subscription model, making costly barrels more accessible to small wineries without a large upfront deposit.

Regional Adaptation Strategies

Shift: Barrel preferences vary regionally. Napa Valley and Bordeaux favour French oak, while American oak is common in South America and Australia. Hybrid casks are gaining popularity in the Asia-Pacific region as wineries explore alternative aging methods. Strategic Response: French Boutes Cooperage increased French oak barrel exports for domestic consumption, contributing approximately 5% growth to Europe’s premium wine sector. Nadalie (USA) expanded American oak barrel production for Australian and South American markets. Their Chinese operation saw a 17% increase in hybrid barrel adoption as wineries sought cost-effective aging for bulk production.

Country-wise Insights

The global wine barrel market is expected to see steady expansion over the next decade, driven by the increasing demand for higher quality wines, growth in vineyard area, and rising popularity of barrel-aged wines. Oak, along with chestnut and cherry wood, are crucial materials in barrel production, significantly influencing the flavor, aroma, and texture of wines through oxidation and tannin extraction.

As consumer palates become more discerning, with a preference for quality and artisanal wines, more vintners are adopting traditional aging processes, thereby stimulating demand for wine barrels. Furthermore, sustainability is becoming increasingly important, leading many wineries to opt for reused and recycled barrels. The projected approximate CAGRs (2025 to 2035) for key markets are provided below:

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

| France | 4.8% |

| Italy | 5.2% |

| Spain | 4.6% |

| Australia | 5.3% |

High-End Wine Production and Barrel Innovation Bolstering USA Market Growth

The wine barrel industry in the USA is experiencing healthy growth, supported by the expansion of high-end wineries in states like California, Oregon, and Washington. Demand from boutique and craft wineries for premium oak barrels that enhance wine structure and depth is a significant driver.

Innovation in barrel technology is also crucial, with wineries experimenting with hybrid oak-stainless steel and varying toast levels to create distinct wine profiles. The focus on sustainability is creating new opportunities, including recycling barrels for use in whiskey aging, furniture, and interior design, maximizing their lifecycle utility.

Additionally, the rise of wine tourism in regions like Napa and Sonoma Valley fuels consistent demand for both new and used barrels utilized in on-site aging programs.

Traditional Winemaking and Premium Aging Driving France’s Market Leadership

As a leading global wine producer, France maintains the highest demand for oak barrels, particularly within its renowned wine regions such as Bordeaux, Burgundy, and Champagne. The deeply ingrained French winemaking heritage continues to emphasize high-quality French oak barrels for their ability to impart refined flavors and tannins.

French producers of luxury wines prioritize barrels that provide exceptional aging capacity and elegance. Innovations in barrel finishing, including steam toasting and extended seasoning, enable the creation of nuanced wine styles that uphold traditional excellence while offering modern refinement.

The French wine industry is also increasingly embracing green and organic practices, with many estates incorporating recycled oak materials into their barrel production as part of their commitment to reducing environmental impact.

Premium Wine Market and Innovation Fueling Australia’s Market Expansion

The Australian wine barrel market is performing strongly, propelled by the growth of vineyards in key states like South Australia, Victoria, and Western Australia. Australia’s emphasis on premium wines has led to increasing demand for oak barrels specifically for aging varietals like Shiraz, Cabernet Sauvignon, and Chardonnay.

Australian winemakers are also exploring alternative oak products such as oak chips and staves to produce quality wines more cost-effectively without sacrificing the complexity gained from traditional barrel aging. Australian cooperages are investing in barrel reconditioning services, extending the usable life of barrels for wineries while maintaining wine quality. The growing interest in organic and natural wines is promoting a trend towards lighter toasted barrels to preserve the wine’s natural aromatic characteristics.

Category-Wise Insights

French Oak Barrels Maintain Dominance Due to Superior Aging Attributes

| Segment | Value Share (2025) |

|---|---|

| French Oak (By Type of Oak) | 59.1% |

French oak barrels are highly sought after by global winemakers for their fine grain, moderate density, and nuanced aromatic compounds, which impart subtle flavors that integrate seamlessly with wine. Unlike the more pronounced vanilla and coconut notes often associated with American oak, French oak offers a more delicate and complex aging profile. This characteristic is particularly favored by premium wineries aiming for subtle and sophisticated aroma development and refined tannins.

French oak typically possesses a higher tannin content, contributing to the wine’s structural integrity and mouthfeel, enabling wines to age gracefully over extended periods while retaining balance. Winemakers frequently select French oak for aging red wines like Cabernet Sauvignon, Pinot Noir, and Merlot, as well as certain full-bodied white wines such as Chardonnay.

The capacity of French oak barrels to enhance complexity, texture, and aromatic depth has solidified their position as the preferred choice for producers of luxury and ultra-premium wines globally. Sustainable forestry practices, especially in regions such as Allier, Tronçais, and Vosges, ensure a consistent supply of high-quality wood. The meticulous craftsmanship and controlled aging environment provided by these barrels underpin their enduring dominance in markets worldwide.

Medium Toast Barrels Prevail as Winemakers Prioritize Balanced Flavors

| Segment | Value Share (2025) |

|---|---|

| Medium Toast (By Toast Level Type) | 46.3% |

Medium toast is the most favored level of barrel toasting among winemakers as it provides a balanced influence on the wine’s flavor composition. The toasting process significantly impacts the aromatic and flavor compounds extracted from the wood, and a medium toast level achieves an optimal balance of desirable elements like vanillin, lactones, and spice notes.

This toast level represents a compromise between lightly and heavily toasted barrels, allowing oak complexity to complement rather than overwhelm the wine’s natural fruit characteristics. Medium-toast barrels are highly versatile, suitable for aging a broad spectrum of wine styles, including robust red wines, elegant white wines, and some rosé wines.

Winemakers value medium-toast barrels for their ability to contribute mouthfeel, a subtle smokiness, and layers of complexity without introducing the sometimes aggressive flavors that can result from intensive oak treatment.

The widespread adoption of medium toast across numerous oak varieties and wine-producing regions globally underscores its significance. Whether the barrels are made from French, American, or Eastern European oak, medium toast accounts for the majority of sales. The demand for medium-toast barrels remains strong, with the trend continuing in North America and Europe as winemakers experiment with different toast levels to define their unique aging profiles.

Competition Outlook

The wine barrel market is primarily driven by key players such as Seguin Moreau Napa Cooperage, Tonnellerie de L’Adour, StaVin Inc., The Barrel Mill, Tonnellerie Radoux USA, A.P. John Cooperage, Canton Cooperage, LLC, and World Cooperage. These companies are recognized for supplying quality oak barrels essential for aging wine, imparting distinct flavors, aromas, and textures.

The increasing demand for premium and vintage wines is fueling the need for highly customized barrels that facilitate precise tannin extraction and oxygen management. Industry leaders are focusing on sustainable oak sourcing, developing innovative barrel toasting technologies, and utilizing advanced cooperage techniques to meet the evolving requirements of winemakers worldwide.

Leading companies in the sector implement various best practices, including scaling up production capabilities to fulfill growing orders from wineries, distilleries, and craft beverage producers. They also offer specialized barrel aging solutions by providing a range of oak types, toast levels, and barrel sizes tailored for diverse wine profiles.

Furthermore, these firms are establishing international distribution channels, often through strategic joint ventures with wineries and vineyard estates, to expand their market presence globally.

For example, **Seguin Moreau Napa Cooperage** employs precise oak selection and specific toasting methods to enhance wine complexity and stability during aging. Similarly, **Radoux USA** has developed Oenofirst, a proprietary oak infusion technology that allows winemakers to achieve exceptional aging results through controlled oak exposure.

Leading Brands

- Seguin Moreau Napa Cooperage

- Tonnellerie de L’Adour

- StaVin Inc.

- The Barrel Mill

- Tonnellerie Radoux USA

- A.P. John Cooperage

- Canton Cooperage, LLC

- World Cooperage

- Billon Cooperage

- Nadalie USA

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 4.5 billion |

| Revenue Forecast for 2035 | USD 6.7 billion |

| Growth Rate (CAGR) | 4.4% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share analysis, competitive landscape review, growth drivers, industry trends |

| Covered Segments | Wood type, toast level, barrel capacity, application, end user |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

| Country Scope | USA, France, Italy, Spain, Australia, China, Argentina, Chile, South Africa |

| Key Companies Analyzed | Seguin Moreau Napa Cooperage, Tonnellerie de L’Adour, StaVin Inc., The Barrel Mill, Tonnellerie Radoux USA, A.P. John Cooperage, Canton Cooperage, LLC, World Cooperage, Billon Cooperage, Nadalie USA, and more |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Wood Type

- French Oak

- American Oak

- Eastern European Oak

- Other Woods (Acacia, Cherry, Chestnut)

- By Toast Level

- Light Toast

- Medium Toast

- Heavy Toast

- No Toast

- By Capacity

- Small Format (under 60 gallons)

- Standard Format (60-90 gallons)

- Large Format (over 90 gallons)

- By Application

- Still Wine Aging

- Sparkling Wine Aging

- Spirit Aging

- Craft Beverage Aging

- By End User

- Large Wineries

- Medium & Small Wineries

- Craft Beverage Producers

- Home Winemakers

Table of Content

- Executive Snapshot

- Market Overview

- Key Market Trends

- Key Success Factors

- Market Demand Analysis 2019 to 2023 and Forecast, 2025 to 2035

- Market – Pricing Analysis

- Market Demand (in Value or Size in USD Billion) Analysis 2019 to 2023 and Forecast, 2025 to 2035

- Market Background

- Market Analysis 2019 to 2023 and Forecast 2025 to 2035, By Wood Type

- French Oak

- American Oak

- Eastern European Oak

- Other Woods

- Market Analysis 2019 to 2023 and Forecast 2025 to 2035, By Toast Level

- Light Toast

- Medium Toast

- Heavy Toast

- No Toast

- Market Analysis 2019 to 2023 and Forecast 2025 to 2035, By Capacity

- Small Format

- Standard Format

- Large Format

- Market Analysis 2019 to 2023 and Forecast 2025 to 2035, By Application

- Still Wine Aging

- Sparkling Wine Aging

- Spirit Aging

- Craft Beverage Aging

- Market Analysis 2019 to 2023 and Forecast 2025 to 2035, By End User

- Large Wineries

- Medium & Small Wineries

- Craft Beverage Producers

- Home Winemakers

- Market Analysis 2019 to 2023 and Forecast 2025 to 2035, By Region

- North America

- Latin America

- Asia Pacific

- Europe

- Middle East and Africa

- North America Market Analysis 2019 to 2023 and Forecast 2025 to 2035

- Europe Market Analysis 2019 to 2023 and Forecast 2025 to 2035

- Asia Pacific Market Analysis 2019 to 2023 and Forecast 2025 to 2035

- Latin America Market Analysis 2019 to 2023 and Forecast 2025 to 2035

- Middle East & Africa Market Analysis 2019 to 2023 and Forecast 2025 to 2035

- Market Structure Analysis

- Competition Analysis

- Seguin Moreau Napa Cooperage

- Tonnellerie de L’Adour

- StaVin Inc.

- The Barrel Mill

- Tonnellerie Radoux USA

- A.P. John Cooperage

- Canton Cooperage, LLC

- World Cooperage

- Billon Cooperage

- Nadalie USA

- Assumptions and Acronyms Used

- Research Methodology