Insights into the Floriculture Industry in Western Europe: Market Size, Dynamics, and Trajectories (2025-2035)

Overview:

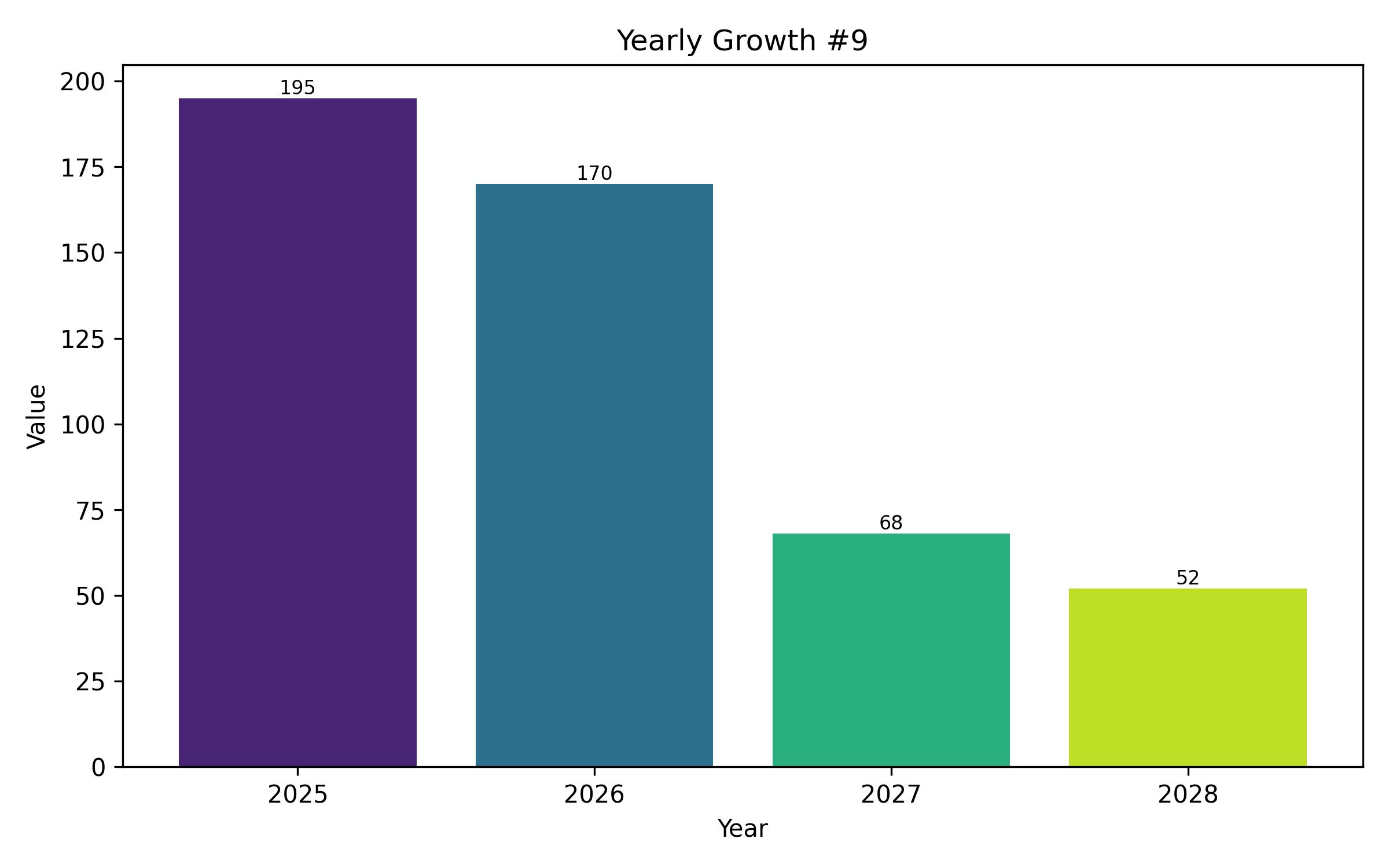

The Western Europe floriculture sector is on track to reach a valuation of USD 16.85 billion in 2025. Industry projections indicate a growth at a steady pace of 5.1% CAGR from 2025 through 2035, potentially achieving USD 28.5 billion by the end of this period. This expansion is propelled by evolving consumer preferences, increasing urbanization, and the growing role of flowers in cultural traditions and daily life.

Heightened consumer interest in enhancing living spaces with plants and flowers, both indoors and outdoors, is a key driver. This trend has been amplified by the post-pandemic focus on well-being and home improvement, as plants are perceived as offering tranquility, natural beauty, and emotional benefits. Consequently, consumers are increasingly purchasing flowers for personal enjoyment beyond typical celebrations like weddings and holidays.

A significant factor contributing to market growth is the increased emphasis on sustainable practices. Consumers in countries such as Germany, France, and the Netherlands and the United Kingdom are becoming more environmentally conscious, preferring locally sourced and seasonal flowers with reduced environmental impact.

This shift supports the growth of domestic floriculture and increases demand for organically produced or pesticide-free flowers. Furthermore, regional governments and agricultural initiatives are providing support through grants and innovation programs aimed at improving yields, minimizing water usage, and integrating technological solutions into greenhouse operations.

Culturally, flowers are embedded in Western European heritage, used in ceremonies, gift-giving, and professional environments. The enduring symbolic value of flowers consistently drives demand across different market segments. Additionally, the rise of online flower delivery services and subscription boxes has made fresh flowers more accessible and convenient, allowing consumers to incorporate them more regularly into their lives rather than reserving them for special events. Advancements in packaging, logistics, and preservation technologies also help ensure flowers remain fresh and available year-round.

The floriculture market in Western Europe is undergoing substantial shifts across various end-use categories, influenced by changing consumer preferences and new trends. In the retail sector, consumers value high-quality and visually appealing flowers, with a growing preference for sustainable options like locally grown flowers and eco-friendly packaging. Online retailers capitalize on the demand for convenience, offering swift delivery, personalized orders, and subscription services, with sustainability playing a significant role in purchasing choices.

Within the wholesale segment, businesses prioritize cost-efficiency and dependable supply, aligning with sustainability goals and employing technology for streamlined logistics. The corporate and events sector prioritizes premium, aesthetically pleasing floral arrangements, with an increasing demand for environmentally conscious sourcing.

Furthermore, there is rising interest in low-maintenance plants that support urban biodiversity, such as wildflowers and pollinator-friendly species. Consumers in this area also look for plants resistant to diseases and pests, reflecting the growing importance of environmental considerations.

Across the board, the prevailing trends of convenience, personalization, and sustainability are reshaping purchasing decisions, as both individual buyers and companies prioritize quality, environmental responsibility, and tailored products. As these trends gain momentum, the floriculture sector must adapt and innovate to meet the market’s evolving demands.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 16.85 billion |

| Revenue Forecast for 2035 | USD 28.5 billion |

| Growth Rate (CAGR) | 5.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company industry share, competitive landscape, growth drivers, and market trends |

| Covered Segments | Type, flower type, end use, sales channel, and country |

| Regional Scope | Western Europe |

| Country Scope | Germany, France, United Kingdom, Italy, Spain, Netherlands, Belgium, Sweden, Norway, Rest of Western Europe |

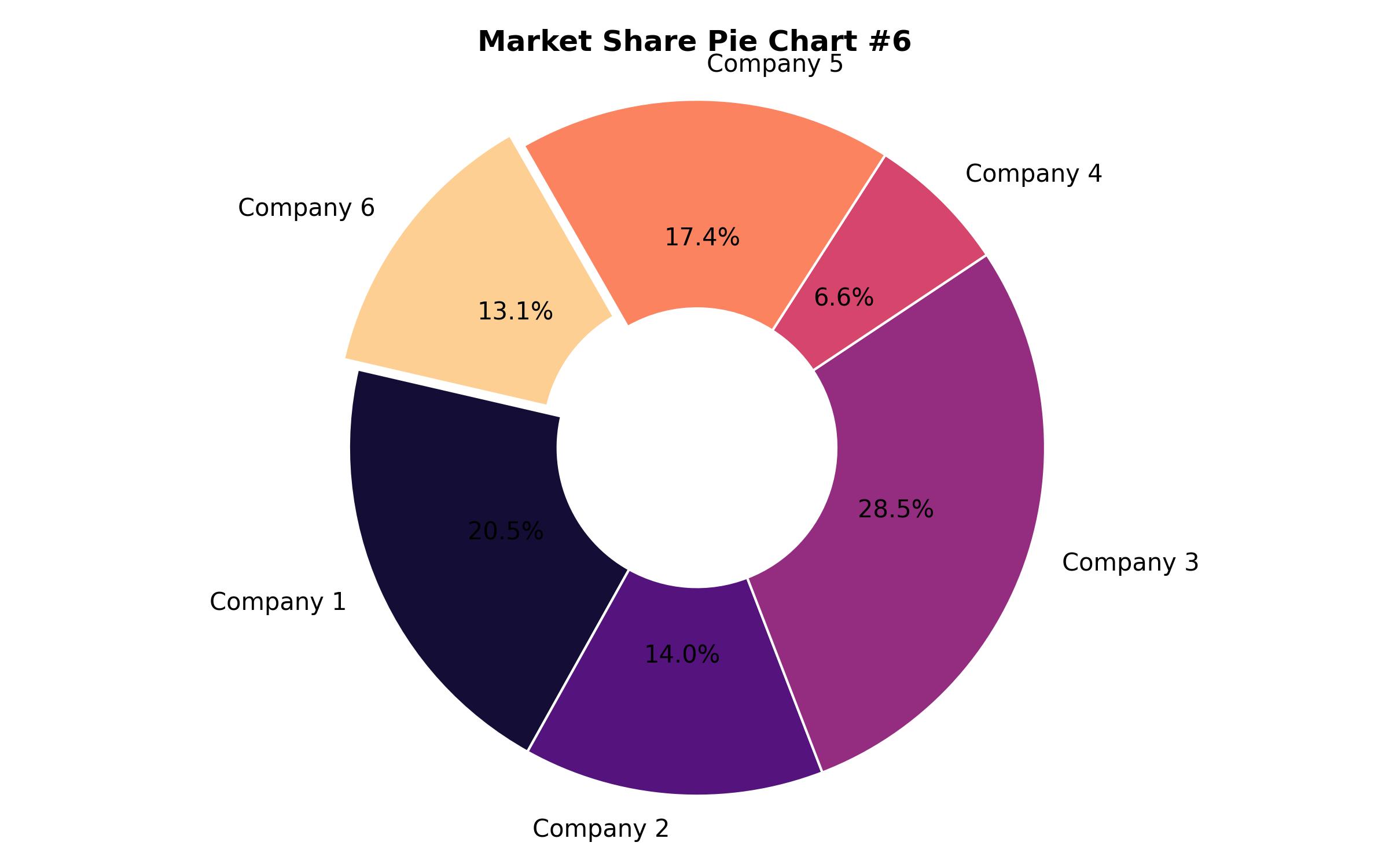

| Key Companies Analyzed | Driscoll’s of Europe B.V., Royal FloraHolland, Forest Produce Ltd., Royal Brinkman UK, Flamingo Flowers Ltd., Eden Horticulture, Selecta Cut Flowers SAU., Native Floral Group, Tropical Foliage Plants, Inc., Verbeek Export B.V. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Type

- Cut Flowers

- Potted Plants

- By Flower Type

- Roses

- Tulips

- Chrysanthemums

- Orchids

- Lilies

- By End Use

- Residential

- Commercial

- Events

- Floral Arrangements

- By Sales Channel

- Florists

- Supermarkets

- Online Retailers

- Wholesalers

- Garden Centers

- By Country

- Germany

- France

- United Kingdom

- Italy

- Spain

- Netherlands

- Belgium

- Sweden

- Norway

Table of Content

- Executive Snapshot

- Market Overview

- Key Market Trends

- Key Growth Drivers

- Market Demand Analysis 2019 to 2024 and Forecast 2025 to 2035

- Pricing Analysis

- Market Volume Analysis 2019 to 2024 and Forecast 2025 to 2035

- Market Background

- Market Analysis by Type 2019 to 2024 and Forecast 2025 to 2035

- Cut Flowers

- Potted Plants

- Market Analysis by Flower Type 2019 to 2024 and Forecast 2025 to 2035

- Roses

- Tulips

- Chrysanthemums

- Orchids

- Lilies

- Other Flower Types

- Market Analysis by End Use 2019 to 2024 and Forecast 2025 to 2035

- Residential

- Commercial

- Events

- Floral Arrangements

- Other End Uses

- Market Analysis by Sales Channel 2019 to 2024 and Forecast 2025 to 2035

- Florists

- Supermarkets

- Online Retailers

- Wholesalers

- Garden Centers

- Other Channels

- Market Analysis by Country 2019 to 2024 and Forecast 2025 to 2035

- Germany

- France

- United Kingdom

- Italy

- Spain

- Netherlands

- Belgium

- Sweden

- Norway

- Rest of Western Europe

- Country-wise Market Analysis 2024 & 2035

- Market Structure Analysis

- Competitive Landscape

- Key Company Profiles

- Strategic Recommendations

- Analyst Insights

- Assumptions and Acronyms

- Research Methodology