Global Plywood Market: Demand Analysis, Technological Advancements, and Strategic Outlook (2025-2035)

Overview:

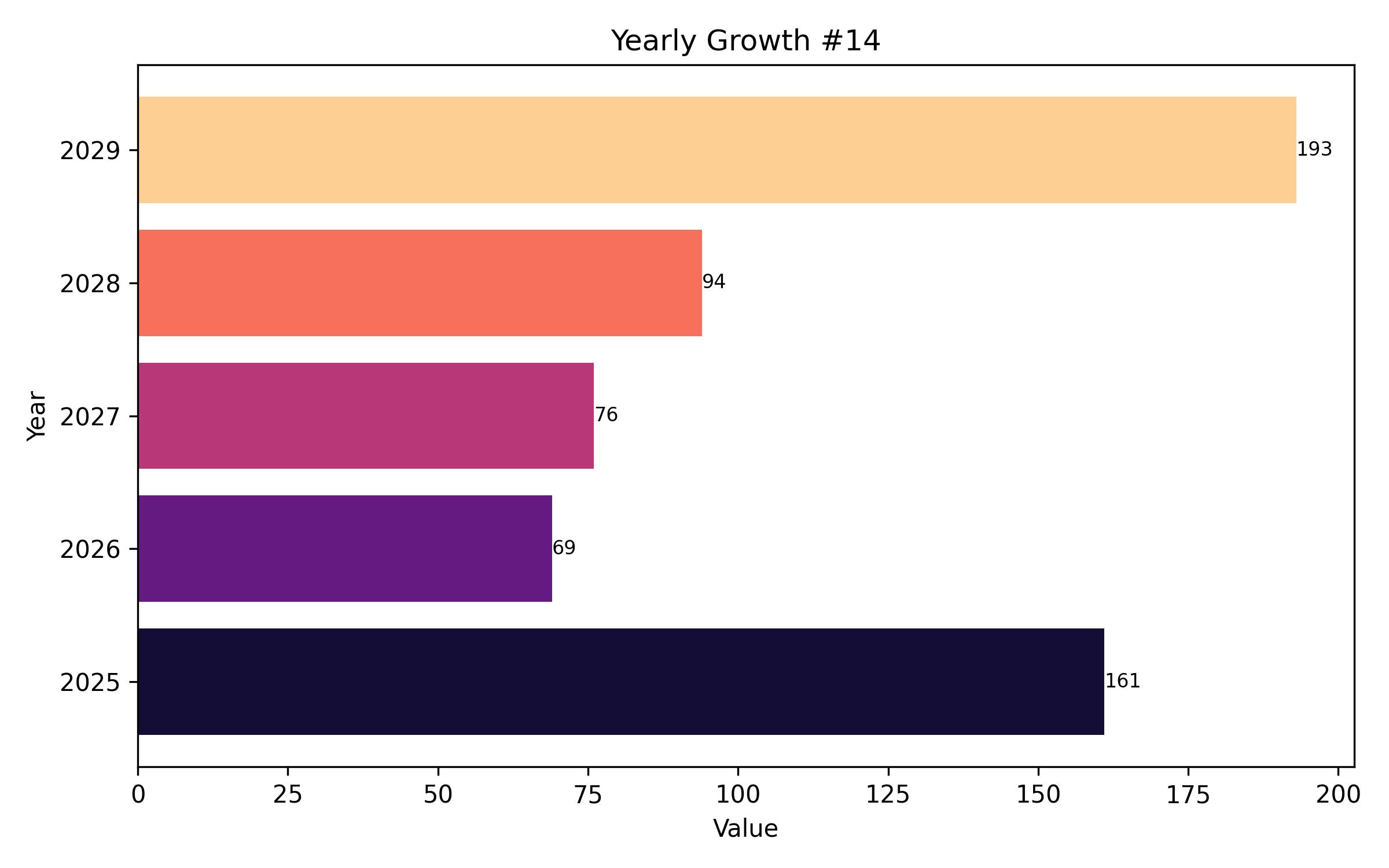

The plywood sector is poised for sustained expansion, with global revenues projected to reach approximately USD 96 billion in 2025 and climb to around USD 172 billion by 2035, exhibiting a compound annual growth rate of about 6% during this period. This upward trend reflects sustained demand from construction activities, a growing preference for sustainably sourced materials, and increasing usage in diverse applications like furniture manufacturing and packaging.

A primary catalyst for market growth is the robust expansion of civil infrastructure globally, with significant activity notably in the Asia-Pacific, parts of Africa, and the Middle East. Plywood is a foundational component in various building projects, including wall systems, roof decking, and subflooring in both residential and commercial structures, valued for its cost-effectiveness and inherent durability.

The furniture and interior design industries also represent a significant demand segment. Plywood’s adaptability for crafting cabinetry, storage units, office furnishings, and decorative panels makes it a preferred material. Its capacity for design flexibility, ease of processing, and dimensional stability against moisture variations position it strongly for contemporary interiors and prefabricated furniture systems.

Advances in manufacturing techniques, including veneer processes, adhesive technologies, and fire-retardant treatments, have considerably enhanced product performance. Developments creating moisture-resistant and decay-resistant varieties are broadening applications into damp or outdoor environments, such as marine vessels, agricultural structures, and industrial facilities.

Challenges faced by the industry include fluctuations in raw material availability, concerns related to forest depletion, and price volatility for timber. Stricter governmental regulations on logging and increasing market demand for certified wood products can push up production expenses, prompting manufacturers to invest in plantation-based and responsible forest management methods.

The market also sees competitive pressure from alternative engineered wood products, including medium-density fiberboard (MDF) and particleboard, particularly in non-structural applications. However, plywood retains a competitive advantage in structural load-bearing requirements and long-term performance, especially where strength-to-weight ratios are critical for the intended use.

Consumer education about sustainable material choices and the longevity benefits of utilizing plywood in construction and furniture applications are also contributing to sustained growth. Furthermore, ongoing research and development into bio-based resins and low-emission adhesives continue to improve the environmental profile of plywood, addressing sustainability concerns within the building industry.

The global shift towards modular and prefabricated construction methods is another trend favoring plywood, as its dimensional stability and ease of fabrication make it well-suited for off-site manufacturing processes. This trend is expected to further boost demand in residential and light commercial building sectors over the forecast period.

Expanding urbanization and investment in public infrastructure projects worldwide, particularly in developing economies, are consistently driving the need for large volumes of building materials, with plywood being a cost-effective choice for various structural elements and formwork. This provides a stable demand foundation for the industry.

Finally, the versatility of plywood applications, ranging from simple utility panels to highly finished decorative surfaces, allows it to serve a broad customer base with varying needs and budgets, ensuring its continued relevance across multiple industrial sectors and geographic regions.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 96 billion |

| Revenue Forecast for 2035 | USD 172 billion |

| Growth Rate (CAGR) | 6.0% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Grade, wood type, size, thickness, number of ply, sales channel, application, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., UK, France, Germany, Italy, South Korea, Japan, China, Australia, New Zealand |

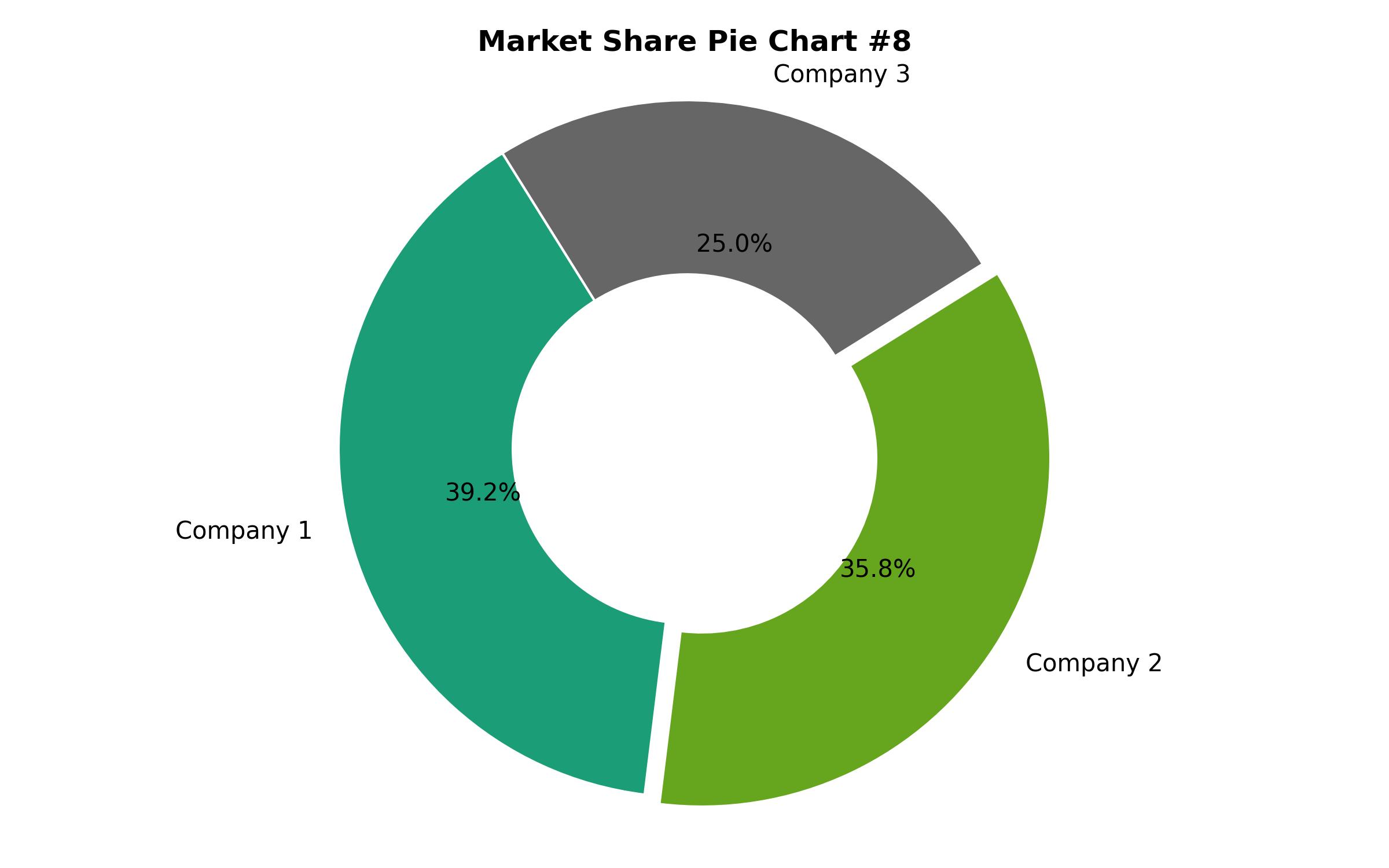

| Key Companies Analyzed | Weyerhaeuser Company, Georgia-Pacific LLC, Boise Cascade Company, Greenply Industries Limited, UPM, Uniply Industries Ltd, Jaya Tiasa Holdings Berhad, Subur Tiasa Holdings Berhad, SVEZA |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

-

By Grade

- MR Grade

- BWR Grade

-

By Wood Type

- Softwood

- Hardwood

-

By Application

- Furniture

- Construction

- Packaging

- Marine

- Flooring

- Interior Design

-

By Region

- North America (U.S., Canada, Mexico)

- Europe (U.K., France, Germany, Italy, Spain)

- Asia-Pacific (China, India, Japan, South Korea, Australia)

- Latin America (Brazil, Argentina)

- Middle East & Africa (UAE, Saudi Arabia, South Africa)

Table of Content

- Executive Snapshot

- Market Overview

- Key Market Trends and Purchasing Criteria

- Market Shifts (2020-2024) and Future Outlook (2025-2035)

- Comparative Market Shift Analysis

- Risk Assessment

-

Market Segmentation Analysis

- Analysis by Grade

- Analysis by Wood Type

-

Country-Wise Analysis

- United States Market

- United Kingdom Market

- France Market

- Germany Market

- Italy Market

- South Korea Market

- Japan Market

- China Market

- Australia Market

- New Zealand Market

- Competitive Landscape

- Market Share Analysis by Company

- Key Company Offerings and Activities

- Key Company Insights

- List of Other Key Players

- Frequently Asked Questions