Comprehensive Report: Japan Baby Powder Market Dynamics, Share, and Emerging Trends from 2025 to 2035

Overview:

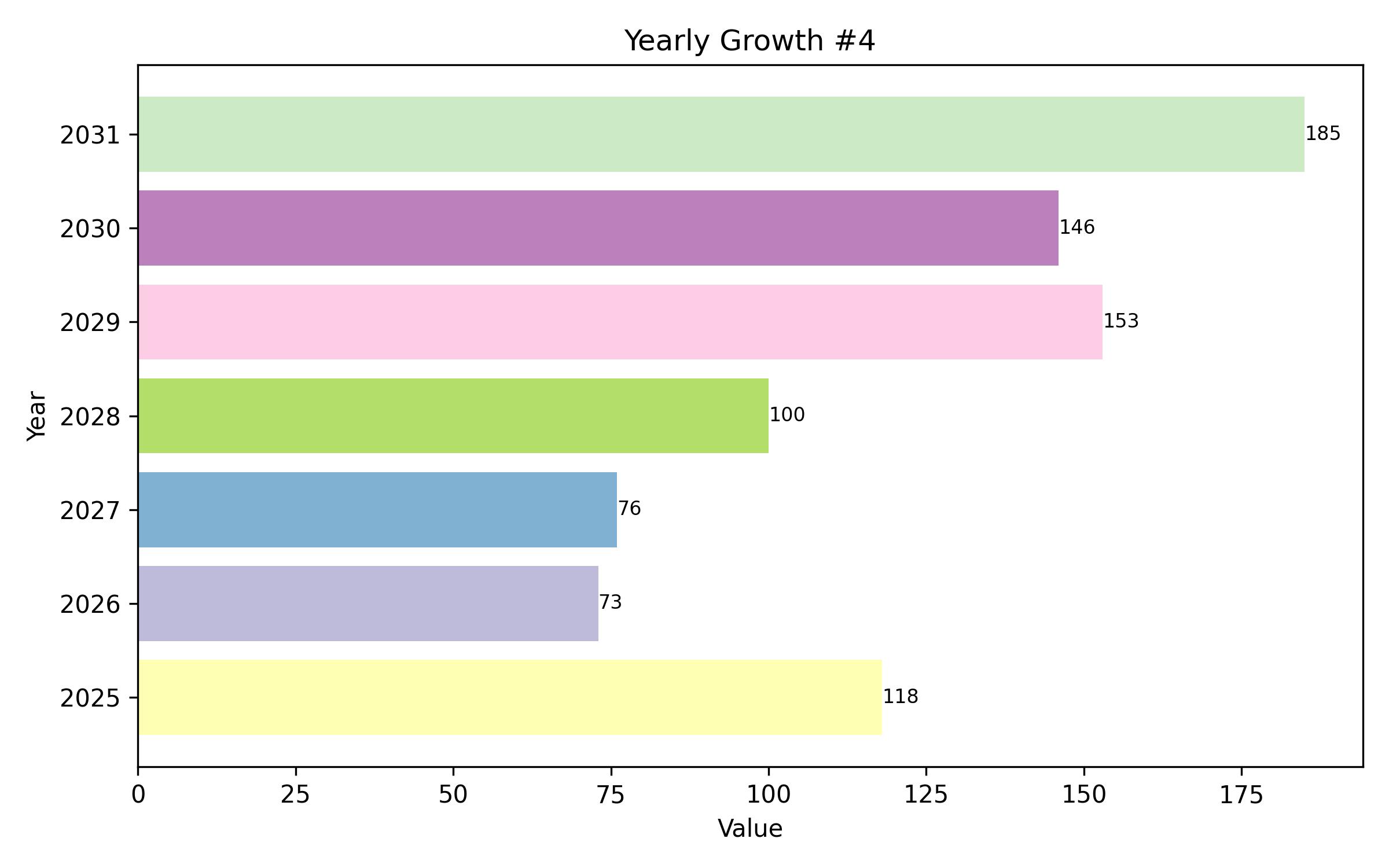

The market for baby powder in Japan is projected to achieve a valuation of USD 48.2 million in the year 2025. The sector is forecast for steady expansion at a compound annual growth rate (CAGR) of 3.95% from 2025 through 2035, anticipating a market size of USD 72.5 million by the end of the forecast period. This market’s trajectory in Japan is influenced by a unique interplay of demographic shifts, evolving consumer health priorities, and deep-seated cultural norms.

Despite the demographic challenge of a declining birth rate in Japan, the market for essential infant care items like baby powder demonstrates considerable resilience. This is primarily attributed to the nation’s heightened emphasis on the quality, hygiene, and safety standards applied to baby care commodities. Japanese parents exhibit a pronounced sensitivity regarding the purity and compatibility of products used on their children, showing a clear preference for hypoallergenic and skin-friendly formulations.

Traditionally used to prevent diaper rash and ensure skin dryness, baby powder is seeing renewed interest due to a shift towards natural and gentler compositions. Modern powder products available in Japan are increasingly moving away from talc-based ingredients. They incorporate alternatives such as modified cornstarch, rice starch, or various natural mineral bases, appealing to caregivers who are increasingly wary of artificial components and prefer botanically-sourced options.

Simultaneously, there is a noticeable surge in the demand for premium and certified organic baby care items. This trend includes higher-end powders that are enriched with select botanical extracts, possess enhanced moisturizing capabilities, and are presented in eco-friendly packaging. These types of products are gaining significant traction, particularly within the urban centers of Japan where consumer purchasing power is generally higher and awareness of global wellness trends is more prevalent.

The rapid growth of e-commerce platforms and the resulting improvement in product accessibility have significantly benefited smaller, specialized, and artisanal brands of baby powder, broadening their reach to a wider consumer base. Digital platforms, including various blogs and social media channels, play a crucial role in augmenting product awareness through features, usage tips, and consumer reviews.

Within the market landscape, distinct trends are observable across key end-use categories: residential households, maternity healthcare facilities, and childcare providers. In private homes, there is a pronounced inclination towards powder formulas that are natural and devoid of talc. This shift is driven by health-conscious parents seeking products made from constituents like cornstarch, rice powder, or herbal elements. The demand for multi-functional powders offering both soothing and hydrating benefits is also on the rise, alongside packaging solutions with minimal environmental impact.

Maternity hospitals prioritize the use of hypoallergenic, fragrance-free powders formulated to meet clinical standards, frequently procured in bulk quantities to align with stringent neonatal care protocols. Some medical facilities are exploring alternative forms, such as formulations that transition from cream to powder, to minimize airborne particle dissemination. Childcare centers, balancing safety considerations with economic factors, tend to opt for moderately priced products that are gentle yet effective for collective use, increasingly favoring more sustainable options like refillable or reduced-waste packaging.

Procurement criteria differ across these user segments, shaped by specific needs and decision-making processes. Parents making household purchases prioritize ingredient safety, brand reputation, endorsements from dermatologists, and user-friendly packaging, often influenced by online feedback and pediatric recommendations. Maternity facilities base choices on medical endorsements, rigorous allergy testing, and product consistency, typically sourcing from specialized medical supply channels. Childcare settings look for cost-effective, easy-to-use, and secure products suitable for group application, with emphasis on application simplicity, storage, and supplier reliability. Across all sectors, there remains an overarching focus on formulas that are gentle and kind to the skin, reflecting Japan’s broader cultural emphasis on exemplary hygiene and care for infants.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 48.2 million |

| Revenue Forecast for 2035 | USD 72.5 million |

| Growth Rate (CAGR) | 3.95% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecasts, company market share, competitive landscape analysis, growth drivers, and industry trends |

| Covered Segments | Ingredient, Price, Nature, Sales Channel, and Region |

| Regional Scope | Japan |

| Country Scope | Japan |

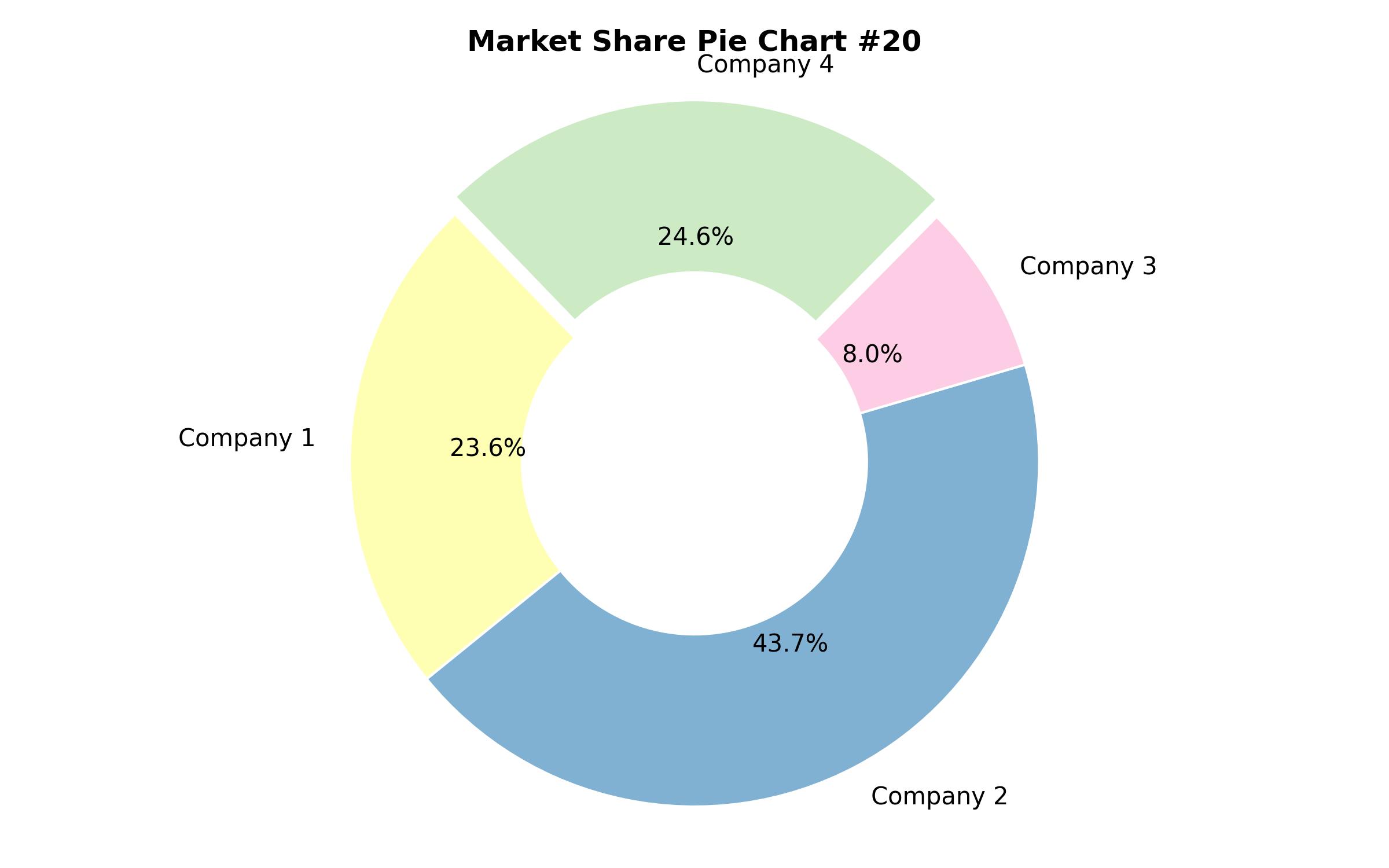

| Key Companies Analyzed | Pigeon, Procter & Gamble Co., Mee Mee, Prestige Consumer Healthcare, Inc., Mothercare, Mamaearth, PZ Cussons, Oriflame Holding AG, Osotspa Company Limited, Mann & Schröder GmbH |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

-

By Ingredient

- Cornstarch

- Talc

- Other Plant Based (rice powder, arrowroot etc.)

- Natural Minerals

-

By Price

- Low

- Medium

- High

-

By Nature

- Organic

- Conventional

-

By Sales Channel

- Online

- Offline

-

By Region

- Japan

Table of Content

- Executive snapshot

- Market Overview

- Key Market Trends

- Regulatory Landscape and Standards

- Market Demand Analysis 2020 to 2024

- Market Forecast 2025 to 2035

- Market Analysis 2025 to 2035, By Ingredient

- Cornstarch-based

- Talc-based

- Other Plant-based

- Natural Minerals

- Market Analysis 2025 to 2035, By Price

- Low-priced

- Medium-priced

- High-priced

- Market Analysis 2025 to 2035, By Nature

- Organic Powders

- Conventional Powders

- Market Analysis 2025 to 2035, By Sales Channel

- Online Retail

- Offline Retail

- Market Analysis 2025 to 2035, By Region

- Japan

- Japan Market Analysis 2025 to 2035

- Key Companies and Market Share Analysis

- Competitive Landscape and Strategies

- Company Profiles

- Growth Opportunities and Future Outlook

- Risk Assessment

- Research Methodology

- Assumptions and Definitions