Intermediate Bulk Container Rental Industry: Market Analysis Covering Demand, Growth, and Future Projections (2025-2035)

Overview:

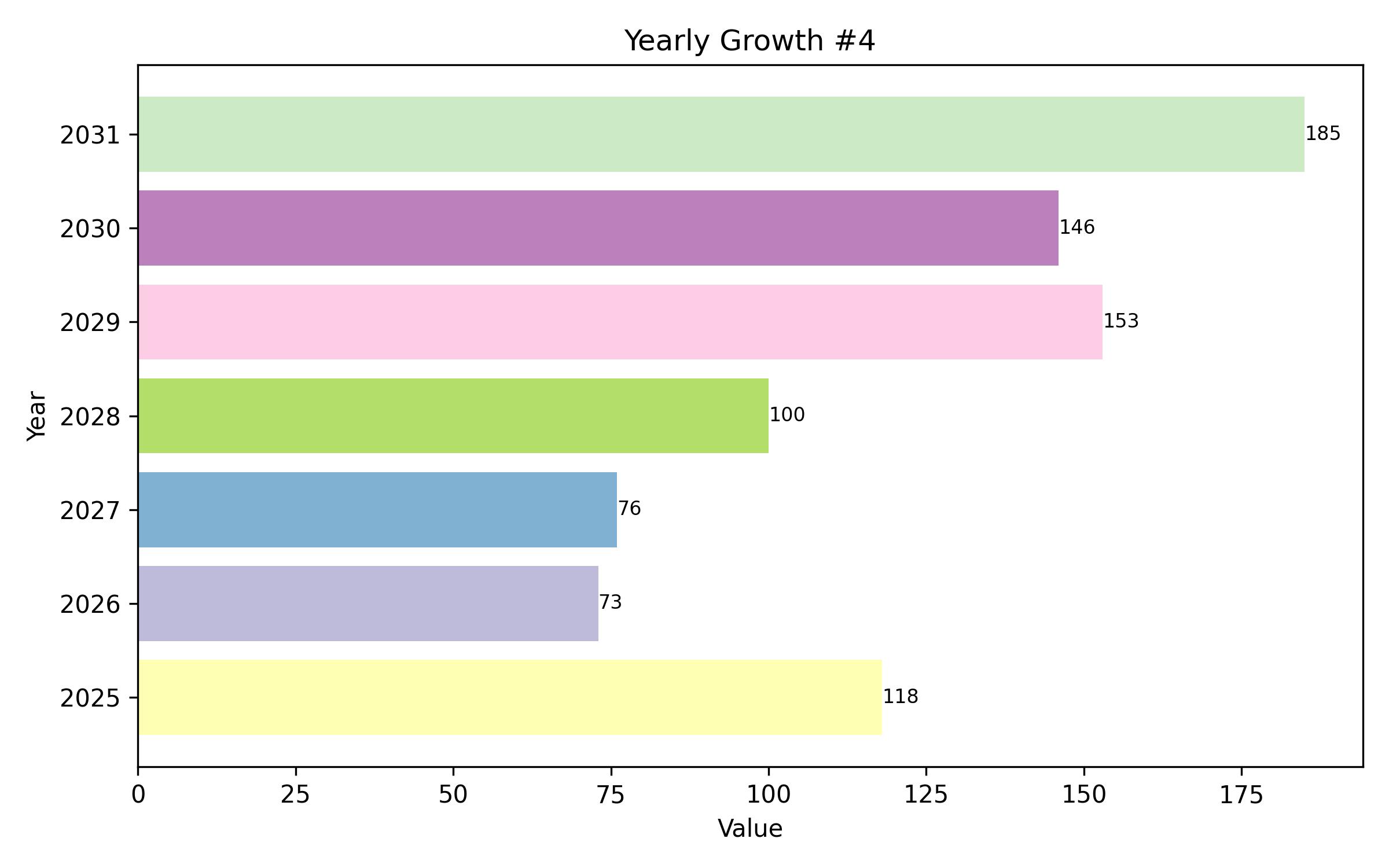

The market for the rental of intermediate bulk containers is expected to reach a valuation of USD 1,440.8 million in 2025. Projections indicate expansion to USD 2,704.6 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.5% over the ten-year forecast period. In 2024, the sector generated revenues of USD 1,352.9 million.

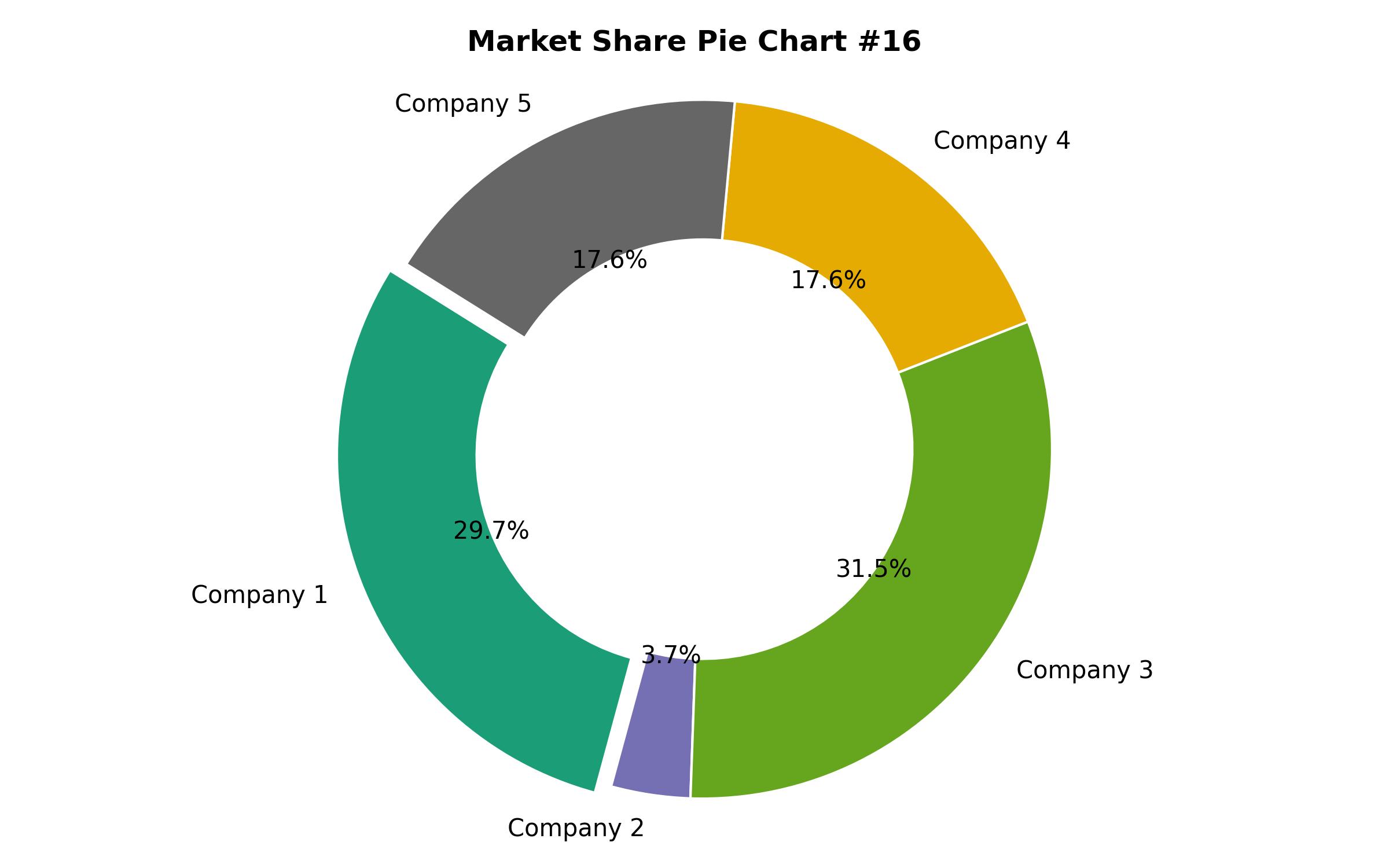

The chemicals sector represents a significant portion of the market, accounting for an estimated 35%. The need for efficient bulk storage and transportation of both hazardous and non-hazardous chemical substances is a key driver. Renting IBCs is favored by chemical manufacturers seeking to minimize capital outlay, enhance supply chain flexibility, and ensure adherence to stringent safety protocols.

Intermediate bulk containers provide critical containment capabilities due to their leak-proof and corrosion-resistant properties. Many are certified for the transport of hazardous goods, offering assurance in handling volatile products. The rental model is particularly attractive for businesses that require frequent upgrades or changes in container types, avoiding substantial long-term investments.

The expansion of the IBC rental market is being propelled by increasing demand for cost-effective, adaptable, and environmentally conscious logistics solutions for bulk liquids and materials. Renting intermediate bulk containers allows enterprises to reduce initial capital expenditure, optimize storage capacity, and meet regulatory requirements without committing to long-term asset ownership.

Key industries driving demand include chemicals, food and beverage, pharmaceuticals, and oil and gas. The broader shift towards circular economy practices, emphasizing reuse and sustainability, is also contributing to market growth. Furthermore, advancements in tracking technologies, including the integration of RFID and IoT within IBCs, are improving supply chain efficiency and making rental options more appealing globally.

Over the forecast period, the IBC rental business is anticipated to present lucrative opportunities. The market is projected to offer an incremental potential value of USD 1,351.7 million, suggesting a significant expansion phase by 2035.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 1,440.8 Million |

| Revenue Forecast for 2035 | USD 2,704.6 Million |

| Growth Rate (CAGR) | 6.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Material, capacity, end-use, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | USA, Germany, China, UK, Spain, India, Canada |

| Key Companies Analyzed | GoodPack Ltd., Hoover Ferguson Group, Inc., Precision IBC Inc., Hoyer Group, TPS Rental Systems, Brambles Ltd (Chep Ltd.), Schoeller Allibert B.V., Arlington Packaging Ltd., Arena Products Inc. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Material

- Plastic IBCs

- Metal IBCs

- Fiberboard IBCs

- By Capacity

- <500 Liters

- 500 – 1,000 Liters

- 1,001 – 1,500 Liters

- >1,500 Liters

- By End-Use Industry

- Chemicals

- Food & Beverage (F&B)

- Pharmaceuticals

- Oil & Gas

- Agriculture

- Paints, Inks & Coatings

- Other Industries

- By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Key Success Factors

- Market Demand Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market – Pricing Analysis

- Market Demand (in Value in USD Million) Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market Background

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Material

- Plastic IBCs

- Metal IBCs

- Fiberboard IBCs

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Capacity

- <500 Liters

- 500 – 1,000 Liters

- 1,001 – 1,500 Liters

- >1,500 Liters

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End-Use Industry

- Chemicals

- Food & Beverage (F&B)

- Pharmaceuticals

- Oil & Gas

- Agriculture

- Paints, Inks & Coatings

- Other Industries

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- South Asia & Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Region-wise Market Analysis 2024 & 2035

- Market Structure Analysis

- Competition Analysis

- Assumptions and Acronyms Used

- Research Methodology