Comprehensive Analysis of the Freeze-Dried Pet Food Market by Segment and Region Through 2035

Overview:

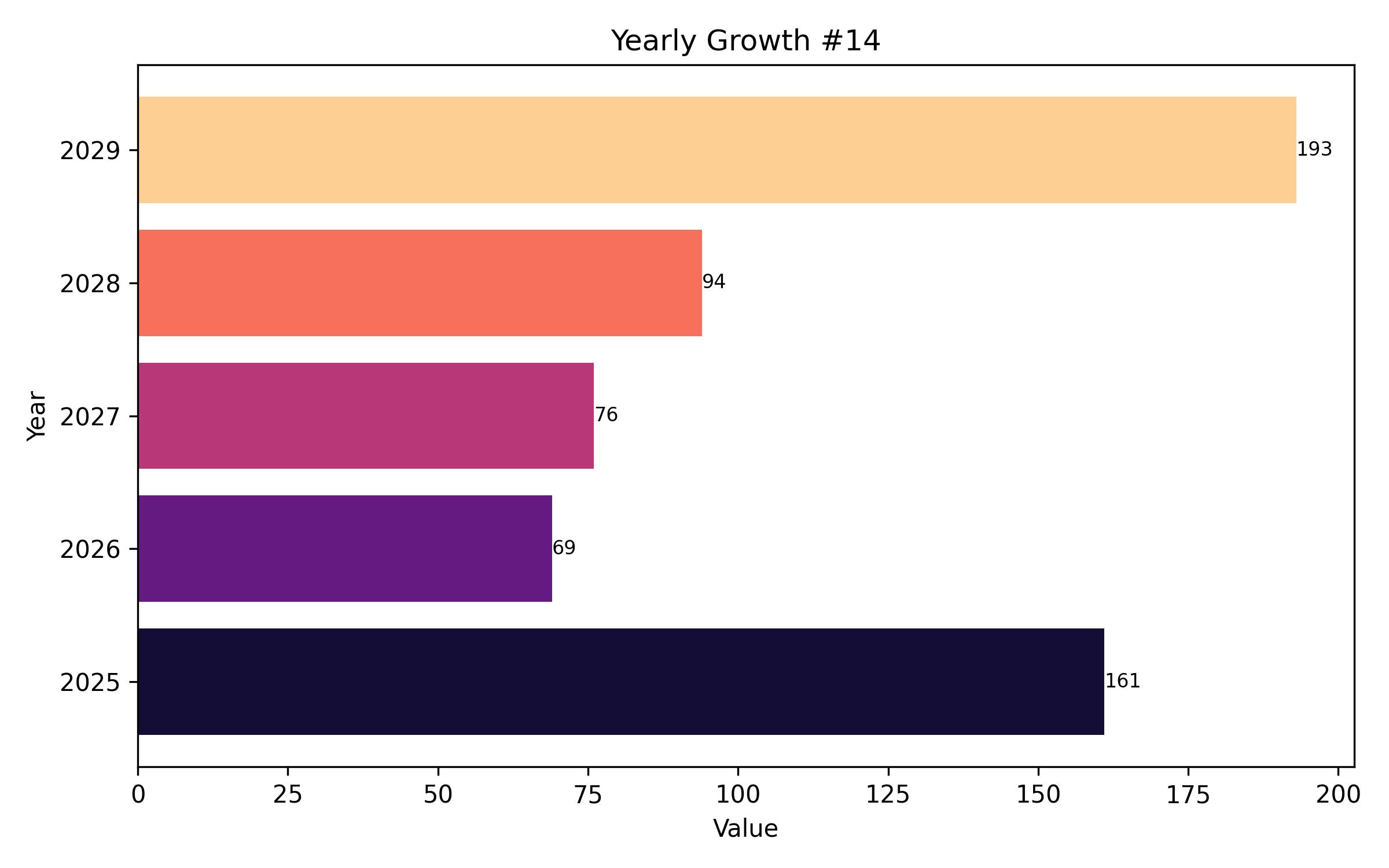

The global market for freeze-dried pet food achieved a valuation of approximately USD 2.02 billion in 2023. Projections indicate growth to around USD 19.1 billion by 2025, reflecting a projected year-over-year increase of about 5.2% in 2024. Looking ahead, the market is anticipated to expand at a steady compound annual growth rate (CAGR) of 5.1% between 2025 and 2035, potentially reaching a total market worth of roughly USD 31.1 billion by the close of that period.

This growth trajectory is driven by increasing awareness among pet owners regarding the benefits of minimally processed, nutrient-rich, and shelf-stable pet food options. Freeze-drying techniques help maintain the nutritional value and natural flavors of ingredients without the need for artificial preservatives, appealing to the growing segment of pet parents seeking high-quality, raw-nutrition inspired diets.

Key trends influencing market development include the rising emphasis on pet health and wellness, leading to greater investment in premium and specialized diets. Demand is particularly strong in regions with high rates of pet humanization and higher discretionary spending on companion animals, such as North America, Western Europe, and parts of Asia Pacific.

The competitive landscape is marked by both established pet food companies and emerging specialized brands focusing on attributes like grain-free, limited ingredient, organic certification, and ethically sourced proteins. Innovation is crucial, with companies exploring alternative protein sources and functional ingredients aimed at specific health benefits like digestive or immune support.

Distribution channels are also evolving, with a noticeable shift towards online retail and direct-to-consumer models, offering convenience and access to a wider product range. However, traditional pet specialty stores and veterinary clinics remain important for consumer education and initial product exposure.

Semi-annual market performance metrics in 2024 and 2025 showed stable expansion. The first half of 2024 recorded a value-based CAGR of 4.7%, supported by consistent consumer interest in premium pet diets. This slightly accelerated to 4.9% in the latter half of 2024 due to seasonal promotions and wider retail presence.

The growth rate remained consistent at 4.9% in the initial half of 2025, as brand investments in supply chain efficiency and product innovation continued. The second half of 2025 is expected to maintain momentum, partly due to expanded e-commerce capabilities and increasing consumer trust in transparent sourcing practices, resulting in a final projected CAGR of 5.0% for the full year.

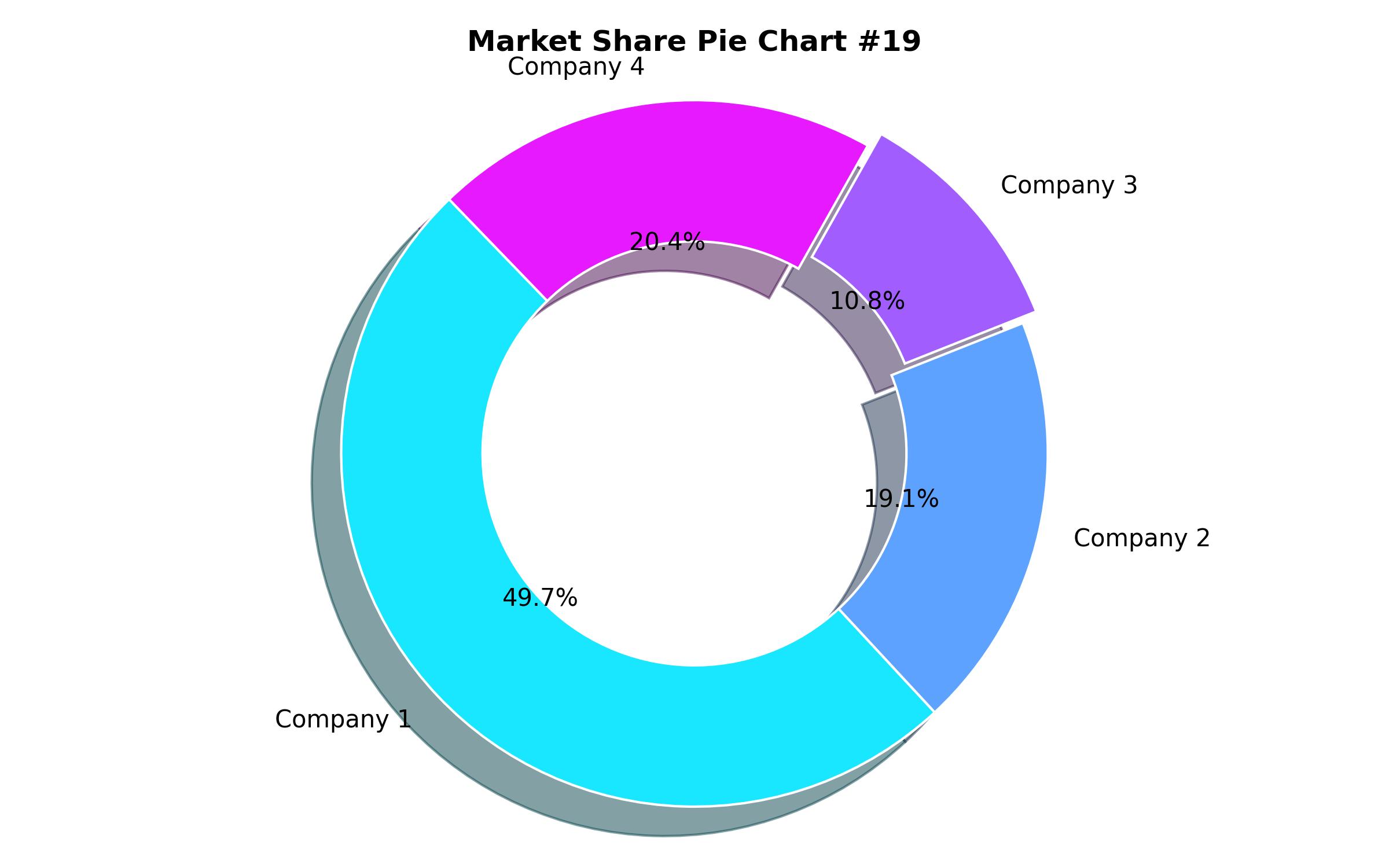

Market concentration varies across tiers. Tier 1 includes large international corporations with extensive distribution and marketing reach. Tier 2 comprises established regional players or specialized manufacturers known for particular product niches or regional strength. Tier 3 consists of newer entrants, often online-first, focusing on very specific market segments or innovative business models like subscription services.

Consumer demand patterns highlight the increasing influence of pet humanization, a focus on tailored nutrition for different life stages, and a preference for highly traceable and sustainable ingredients. Brands are responding by enhancing product transparency, developing specialized formulas, adopting eco-friendly practices, and leveraging digital platforms for sales and consumer engagement.

Regional growth prospects are strong across the board. North America leads due to its mature premium pet food market. Asia Pacific is the fastest-growing region, fueled by urbanization and rising incomes. Europe emphasizes clean labels and ethical sourcing. Latin America and the Middle East and Africa represent emerging opportunities, particularly in urban centers adopting global pet care trends.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 19.1 billion |

| Revenue Forecast for 2035 | USD 31.1 billion |

| Growth Rate (CAGR) | 5.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Pet type, nature, source, process type, and sales channel |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, France, China, Japan, India, Brazil, South Africa, UAE |

| Key Companies Analyzed | Nature’s Variety, Primal Pet Foods, Ranova, TruPet, Steve’s Real Food, Stewart Pet Food, and others |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

-

By Pet Type

- Dog

- Puppy

- Adult

- Senior

- Cat

- Kitten

- Adult

- Senior

- Other Small Animals

- Dog

-

By Nature

- Organic

- Conventional

-

By Source

- Animal-Based

- Plant-Based

- Insect-Based

- Blends

-

By Process Type

- Raw Freeze-Dried

- Cooked Freeze-Dried

-

By Sales Channel

- Retail Stores

- Online Stores

- Direct-to-Consumer (DTC)

- Veterinary Clinics

-

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Table of Content

- Executive Summary

- Market Overview

- Key Trends and Innovations

- Demand Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Pricing Landscape Analysis

- Market Value Chain Analysis

- Market Demand (in USD Million) Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market Dynamics

-

Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Pet Type

- Dog

- Cat

- Other Small Animals

-

Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Nature

- Organic

- Conventional

-

Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Source

- Animal-Based

- Plant-Based

- Insect-Based

- Blends

-

Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Process Type

- Raw Freeze-Dried

- Cooked Freeze-Dried

-

Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Sales Channel

- Retail Stores

- Online Stores

- Direct-to-Consumer (DTC)

- Veterinary Clinics

-

Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Asia Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Region-wise Market Share Analysis 2025 & 2035

- Competition Landscape

- Key Company Profiles

- Assumptions and Disclaimers

- Research Methodology