Global Probiotic Cheese Market Analysis by Cheese Type, Bacteria, Sales Channel, and Region through 2035

Overview:

The worldwide market for cheese featuring beneficial bacteria is set to expand from an estimated value of USD 603 million in 2025 to approximately USD 2,458.5 million by 2035, exhibiting a substantial compound annual growth rate of 15.1% over the decade. This follows a market size of USD 526.2 million in 2024, indicating a rising consumer interest in functional dairy items perceived to support digestive wellness and immune functions.

Cheese infused with probiotics offers a dual benefit, combining the pleasure of consumption with potential health advantages. As consumers increasingly prioritize functional foods for their well-being, this category is transitioning from a niche offering to a more widespread consumer trend. The incorporation of live microorganisms like Lactobacillus acidophilus and Bifidobacterium species not only enhances the nutritional profile of the cheese but also provides brands with a distinct selling point in the dairy section.

Among the various types of cheese, hard and semi-hard varieties are particularly popular in the probiotic category, owing to their enhanced stability and the ability to maintain a higher concentration of active cultures over a longer period. Ongoing technological improvements in flavor development, fat content management, and natural ingredient sourcing are facilitating the availability of these products beyond health-focused retailers, reaching into mainstream supermarkets, food service establishments, and cafes.

From a geographical standpoint, North America and Western Europe continue to be significant markets, propelled by strong consumer awareness and a willingness to purchase premium products. Regions such as South Asia and East Asia, encompassing areas like India, China, and Japan, demonstrate promising growth trajectories. This growth is supported by expanding urban populations with increasing health consciousness and a growing adoption of functional diets influenced by Western lifestyles.

Distribution methods are becoming increasingly omnichannel. Online retailers and subscription services focusing on health and wellness are emerging as strong contenders alongside traditional specialty stores and natural food shops. Companies are strategically employing brand narratives, emphasizing clean labels, and pursuing certifications to validate probiotic efficacy, with the goal of fostering consumer trust and distinguishing their products in a competitive market.

| Attributes | Description |

|---|---|

| Estimated Global Probiotic Cheese Industry Size (2025) | USD 603 million |

| Projected Global Probiotic Cheese Industry Value (2035) | USD 2,458.5 million |

| Value-based CAGR (2025 to 2035) | 15.1% |

Leading companies in the sector, including Danone S.A., Lifeway Foods, Arla Foods, Nestlé, and Chr. Hansen, are expanding their research and development initiatives. These efforts are focused on creating bioactive cultures that can be effectively integrated into cheese matrices to enhance both flavor characteristics and the stability and shelf life of the added beneficial microorganisms.

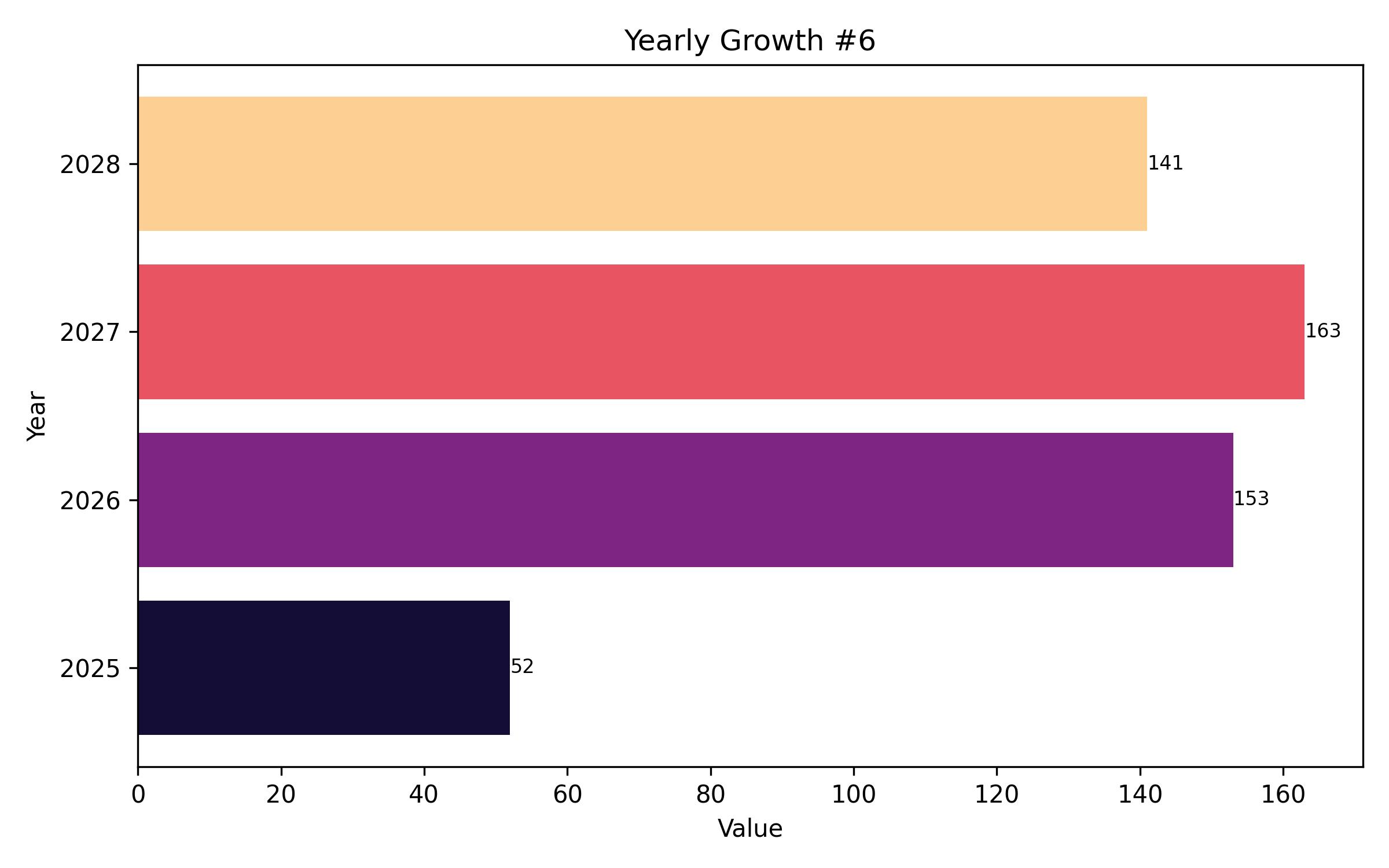

A comparison of growth rates over six-month intervals highlights the market’s performance dynamics. The first half of the 2025-2035 period is expected to see a CAGR of 14.9%, slightly less than the 15.1% anticipated for the second half. This represents an acceleration compared to a 14.3% CAGR in H1 2024 and a 14.6% CAGR in H2 2024, reflecting a rebound in consumer interest in functional dairy. Key drivers for this growth include expanding distribution networks, a focus on clear ingredient labeling, and continued research emphasizing the positive impact of probiotics in cheese on intestinal health.

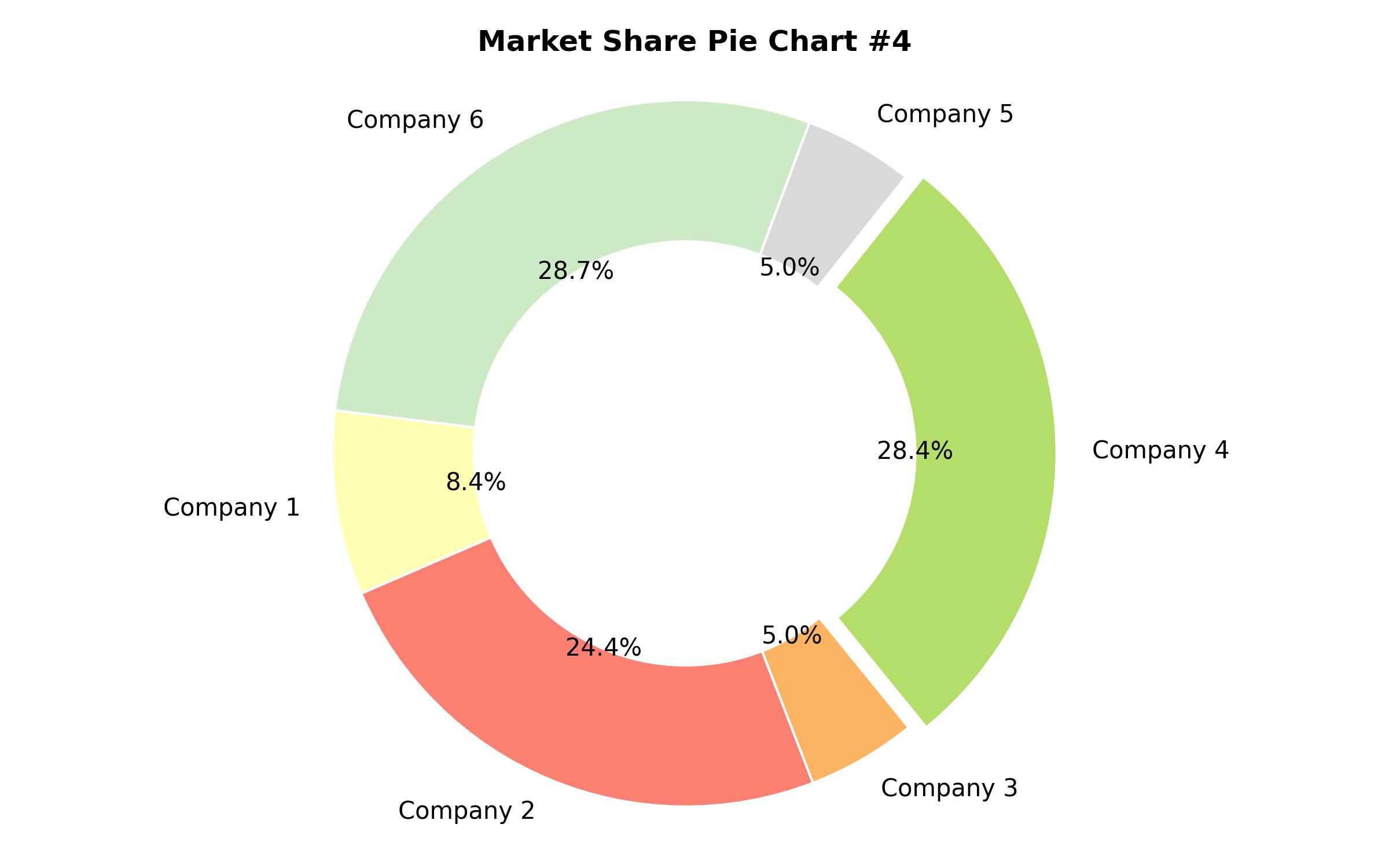

Leading the market are a few major corporations that leverage their extensive dairy portfolios, established international distribution networks, and substantial investments in research and development to enhance their cheese product lines with probiotics. Danone S.A., for instance, has utilized its expertise in functional dairy and probiotics to enter the cheese segment through product innovation and health-focused branding strategies.

Nestlé S.A., widely recognized for its diverse range of dairy offerings, has also launched probiotic-enhanced cheese products, particularly targeting markets in North America and Europe. These larger companies benefit from their scale, strong brand recognition, and advanced fermentation capabilities, enabling them to maintain leadership in both retail and foodservice channels and to inform consumers about the health benefits of gut-friendly foods.

Comprising Tier 2 are companies that possess considerable regional influence and product diversity, although with a more limited global presence compared to Tier 1. Arla Foods, for example, has successfully positioned probiotic features within its premium cheese selections in Western European and Scandinavian markets. Similarly, the Fonterra Co-operative Group has developed functional cheese products under various brands, catering to markets in Oceania and Asia.

These marketers underscore the importance of natural ingredients, regionally sourced dairy, and functional nutrition to build a strong market position among consumers seeking premium and health-conscious cheese options. They actively collaborate with nutrition experts and research institutions to validate health claims and reinforce authenticity within the functional food sector.

The third tier includes artisanal regional brands, small-scale dairy producers, and emerging companies dedicated to researching and developing novel probiotic strains for use in diverse cheese formats. These market participants aim to serve specific consumer niches, emphasizing product differentiation through natural ingredients, organic status, and small-batch production techniques. Brands like Lively Culture Creamery and other smaller European and North American players distribute their artisanal probiotic cheeses via farmers’ markets, specialized food retailers, and directly to consumers, focusing on unique taste profiles and sustainable practices.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 603 million |

| Revenue Forecast for 2035 | USD 2,458.5 million |

| Growth Rate (CAGR) | 15.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Cheese Type, Bacteria Type, Sales Channel, End User, Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Country Scope | U.S., Canada, Germany, U.K., France, China, India, Japan, Brazil, UAE, Saudi Arabia, South Africa |

| Key Companies Analyzed | Beehive Cheese, Bel Gioioso, Cabot Creamery, East Hill Creamery, Danone SA, Good Culture, Vermont Farmstead Cheese Co., The Probiotic Cheese Co., Arla Foods, Others |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Cheese Variety

- Cheddar

- Mozzarella

- Gouda

- Cream Cheese

- Feta

- Other Varieties

- By Bacteria Type

- Lactobacillus Species

- Bifidobacterium Species

- Streptococcus Thermophilus

- Combinations

- Other Strains

- By Sales Channel

- Supermarkets and Hypermarkets

- Specialty Food Stores

- Online Retail

- Foodservice

- Direct-to-Consumer

- By End User

- Residential

- Commercial

Table of Content

- Executive Snapshot

- Market Overview

- Key Market Trends

- Key Success Factors

- Market Demand Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market – Pricing Analysis

- Market Demand (in Value or Size in USD Billion) Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market Background

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Cheese Variety

- Cheddar

- Mozzarella

- Gouda

- Cream Cheese

- Feta

- Other Varieties

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Bacteria Type

- Lactobacillus Species

- Bifidobacterium Species

- Streptococcus Thermophilus

- Combinations

- Other Strains

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Sales Channel

- Supermarkets and Hypermarkets

- Specialty Food Stores

- Online Retail

- Foodservice

- Direct-to-Consumer

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End User

- Residential

- Commercial

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Asia Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Middle East and Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Region-wise Market Analysis 2025 & 2035

- Market Structure Analysis

- Competition Analysis

- Beehive Cheese

- Bel Gioioso

- Cabot Creamery

- East Hill Creamery

- Danone SA

- Good Culture

- Vermont Farmstead Cheese Co.

- The Probiotic Cheese Co.

- Arla Foods

- Others

- Assumptions and Acronyms Used

- Research Methodology