Insoluble Dietary Fiber Market: Global Industry Assessment, Growth Trajectory, and Ten-Year Outlook (2025-2035)

Overview:

The global market for insoluble dietary fiber is projected to reach a valuation of USD 3.15 billion in 2025. Over the period from 2025 to 2035, the market is anticipated to expand at a compound annual growth rate (CAGR) of 9.1%, leading to an estimated value of USD 7.53 billion by the end of the forecast period. In comparison, the market experienced a CAGR of 8.6% between 2020 and 2025.

Insoluble dietary fiber refers to plant-based carbohydrates that do not dissolve in water. These fibers are recognized for their role in promoting regular bowel movements and aiding in the prevention of constipation. Adequate consumption of insoluble fiber is widely considered beneficial for overall digestive health and is frequently recommended as part of a balanced meal plan.

Developing advanced and health-focused insoluble dietary fiber products represents a potentially fruitful strategic path for manufacturers. Investments in research and development can enable optimization of processing methods, leading to the creation of innovative and convenient fiber solutions. Expanding production capacity is also expected to provide substantial investment opportunities for market participants.

Companies can bolster their output within the forecast timeframe by establishing new facilities and enhancing existing equipment. Furthermore, investing in marketing and promotional activities holds significant growth potential in the current market environment. Leveraging social media platforms to promote specific supplements and build brand recognition is anticipated to contribute to increased visibility for manufacturers in the coming years.

The rising consumption of nutrient-rich foods, alongside growing interest in dietary supplements and nutraceuticals, is influencing market dynamics. Factors such as heightening consumer awareness regarding health, governmental initiatives promoting wellness, and evolving dietary preferences are key drivers. Additionally, the increasing popularity of weight management strategies and a focus on nutritional fiber content are expected to boost demand for insoluble substances throughout the analysis period.

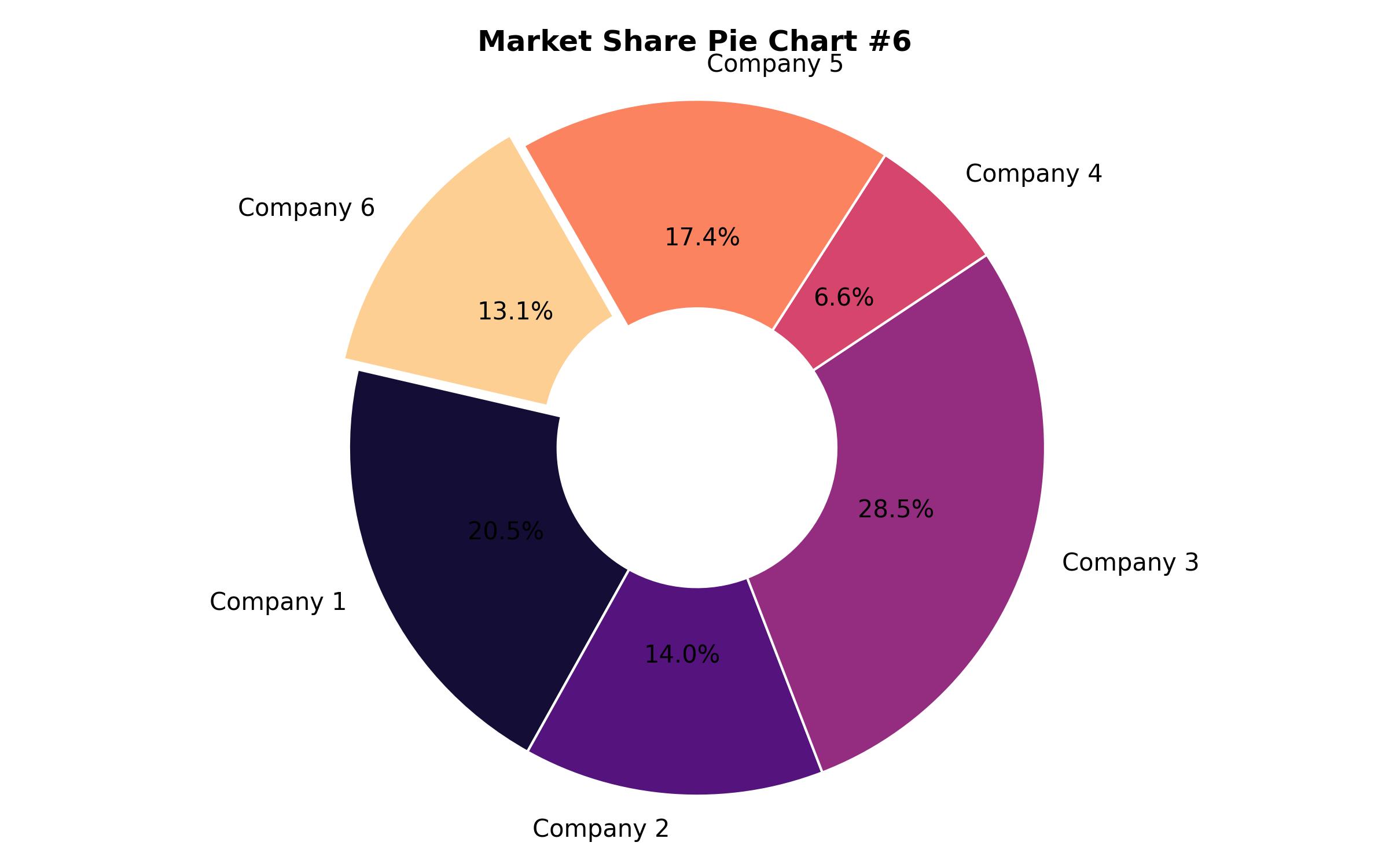

Tier 1 companies, identified as industry leaders, hold a significant portion of the global market, approximately 50%. These entities are characterized by their extensive product offerings and substantial production volumes. They possess a broad geographic footprint, deep expertise in manufacturing and processing across various forms, and a strong customer base. Their operations often involve modern technology and adherence to relevant quality and regulatory standards.

Tier 2 companies represent mid-sized players with a presence in specific regions, holding about 30% of the market share. These firms are known for a solid global presence and sound business operations. While they may not always have the latest technology or the widest global reach compared to Tier 1, they utilize capable technology and maintain compliance with regulations.

Tier 3 companies typically consist of smaller businesses serving localized or niche markets, accounting for approximately 20% of the market share. Their focus on serving local requirements distinguishes them. This segment is often viewed as less formally organized compared to the larger tiers, with a more limited geographic scope.

Geographically, the United States, Germany, and China are identified as significant consumption centers. Projections show these countries are expected to exhibit CAGRs of 5.6%, 4.8%, and 7.6%, respectively, through 2035. The market in the USA is expanding, partly due to increasing health consciousness among consumers. There is a growing preference for natural approaches to maintaining well-being, leading many Americans to favor insoluble dietary fibers in recent years.

The USA market specifically benefits from the perception of insoluble dietary fiber’s advantages, including its potential to reduce the risk of certain health issues and prevent constipation. As the incidence of digestive health concerns has risen in the country, healthcare professionals have increasingly recommended insoluble dietary fibers to support digestive function. China’s market growth is anticipated to contribute positively to the insoluble dietary fiber sector, driven in part by its food and beverage industry’s efforts in incorporating fiber into various products as consumers seek healthier alternatives.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 3.15 Billion |

| Revenue Forecast for 2035 | USD 7.53 Billion |

| Growth Rate (CAGR) | 9.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Product Type, Application, and Region |

| Regional Scope | North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East & Africa |

| Country Scope | U.S., Canada, Mexico, Rest of North America, Brazil, Argentina, Rest of Latin America, Germany, France, U.K., Italy, Spain, Rest of Europe, India, Pakistan, Thailand, Rest of South Asia, China, Japan, South Korea, Rest of East Asia, Australia, New Zealand, Rest of Oceania, GCC, Israel, South Africa, Rest of MEA |

| Key Companies Analyzed | Unipektin Ingredients AG, DuPont de Nemours and Company, Tate & Lyle PLC, Cargill Incorporated, TIC GUMS Inc., Roquette Frères, Südzucker Ag, Grain Processing Corporation, Others |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Product Type

- Cellulose

- Hemicellulose

- Lignin

- Chitosan

- Others

- By Application

- Food and Beverages

- Pharmaceuticals

- Animal Feed

- Others

- By Region

- North America

- Latin America

- Europe

- South Asia

- East Asia

- Oceania

- Middle East & Africa

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Key Success Factors

- Market Demand Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market – Pricing Analysis

- Market Demand (in Value in USD Billion) Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market Background

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Product Type

- Cellulose

- Hemicellulose

- Lignin

- Chitosan

- Others

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Food and Beverages

- Pharmaceuticals

- Animal Feed

- Others

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Latin America

- Europe

- South Asia

- East Asia

- Oceania

- Middle East & Africa

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- South Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Oceania Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Region-wise Market Analysis 2025 & 2035

- Market Structure Analysis

- Competition Analysis

- Unipektin Ingredients AG

- DuPont de Nemours and Company

- Tate & Lyle PLC

- Cargill Incorporated

- TIC GUMS Inc.

- Roquette Frères

- Südzucker Ag

- Grain Processing Corporation

- Assumptions and Acronyms Used

- Research Methodology