Mood Enhancement Supplement Market Analysis by Key Ingredient, Product Form, and Sales Channel Through 2035

Overview:

The global market for mood-enhancing supplements reached approximately USD 735 million in 2024. This market saw an increase of around 2% in 2025, bringing the total demand to over USD 751 million. Projections indicate that sales of these supplements are set to exceed USD 1.1 billion by the close of 2035, exhibiting a compound annual growth rate (CAGR) of 3.3% between 2025 and 2035.

Heightened public awareness regarding the importance of mental well-being and its integration into overall health priorities significantly bolsters the market for mood support supplements. This growing focus encourages consumers to explore natural and effective methods for improving mood and reducing stress. Consequently, supplements containing botanical ingredients such as ashwagandha, valerian, and St. John’s Wort are experiencing soaring demand.

The increasing recognition of mental wellness, particularly among younger demographics, has intensified the desire for non-pharmaceutical options for mood enhancement and anxiety relief. Furthermore, the rising prevalence of conditions like anxiety and depression, combined with a preference for holistic health strategies, is expected to sustain the demand for these supplements.

The expansion of retail accessibility through both physical stores and online platforms has also contributed to the market’s growth. In addition, numerous companies are innovating their product formulations by incorporating traditional ingredients with modern processing techniques to enhance their effectiveness.

A table summarizing key market attributes reveals the estimated global industry size at USD 751 million in 2025 and a projected value of USD 1.1 billion by 2035, with a value-based CAGR of 3.3% from 2025 to 2035.

Consumer preference for natural and plant-derived products is anticipated to further propel market expansion in the coming years. The influence of social media and digital influencers continues to fuel interest and maintain the momentum around mental wellness. Moreover, the development of personalized wellness solutions tailored to individual needs and preferences is set to enhance the perceived effectiveness and broader acceptance of these supplements.

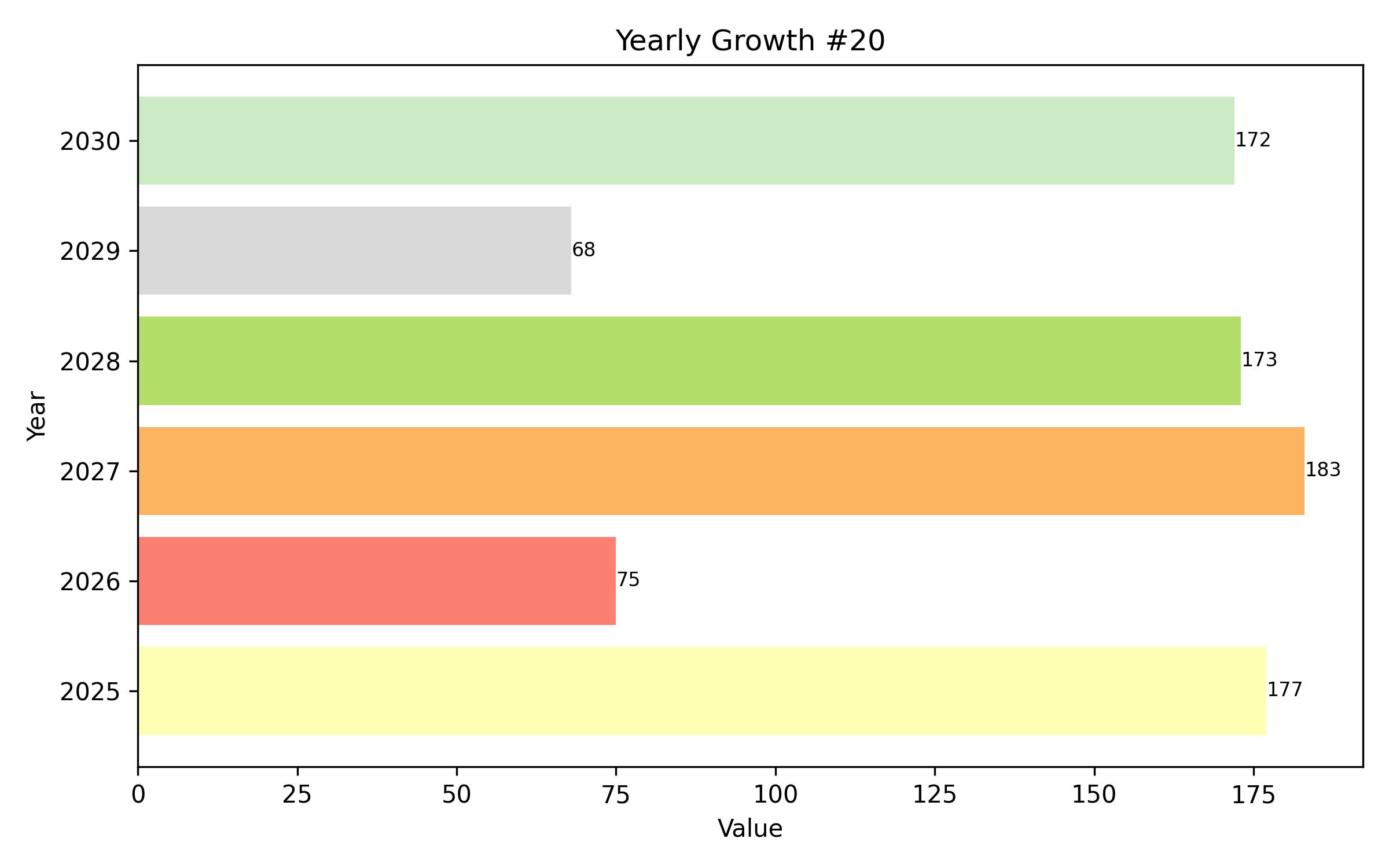

An analysis of the six-month change in CAGR indicates an upward trend. For the period 2024 to 2034, the first half (H1) showed a CAGR of 2.9% and the second half (H2) registered 3.1%. For 2025 to 2035, the H1 CAGR was 3.4% and H2 reached 3.6%. This illustrates a consistent increase in consumer interest and market growth potential.

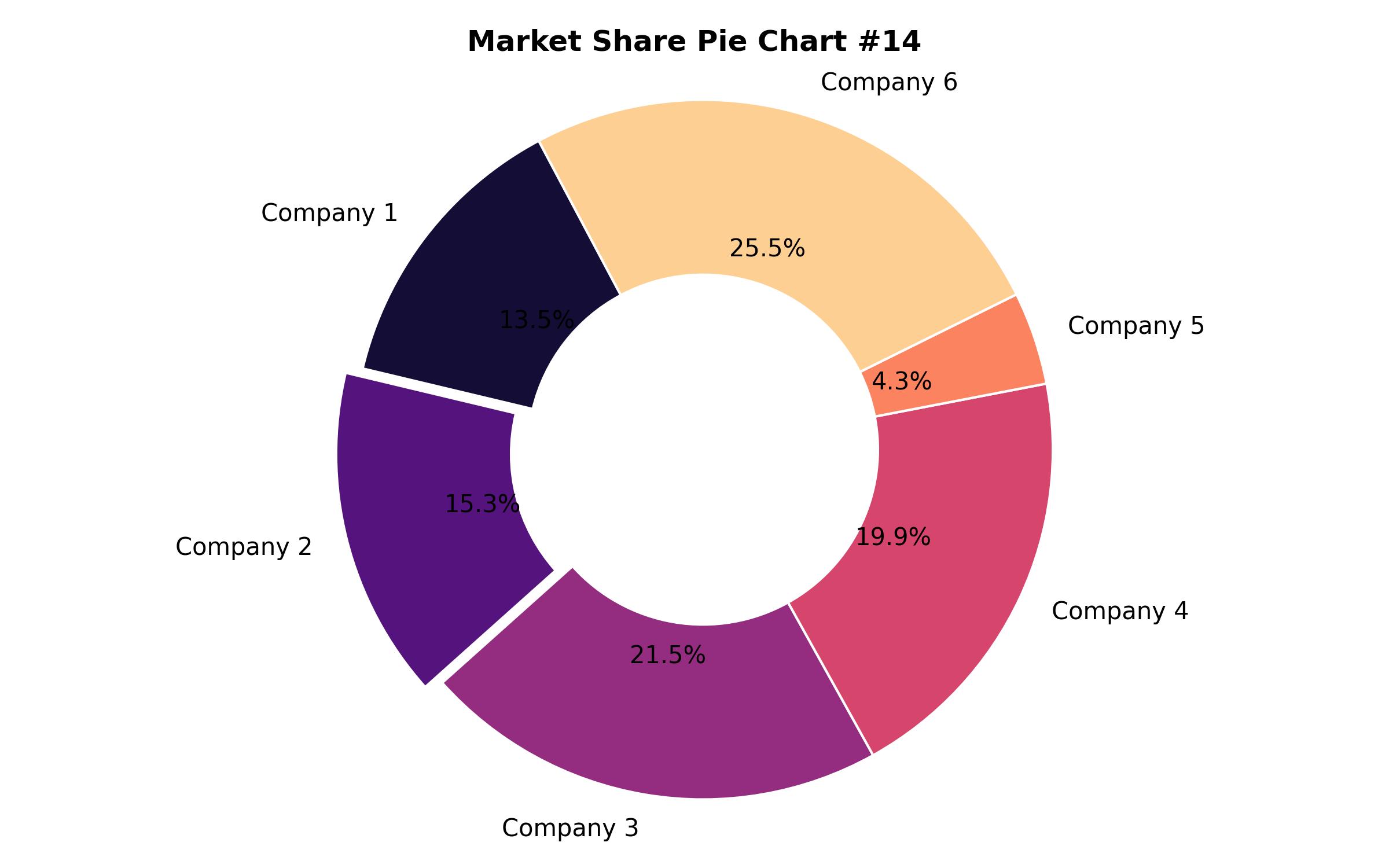

Market concentration analysis identifies three tiers of companies. Tier 1 includes major players with significant revenue, extensive global presence, and broad product portfolios, known for substantial investment in R&D and clinical trials. Tier 2 companies hold moderate revenue and possess strong regional or niche market positions, recognized for their specialized product lines and focus on specific consumer segments. Tier 3 comprises newer and smaller brands primarily leveraging e-commerce and digital marketing strategies.

Several key demand trends are shaping the market, including the reformulation of products for health-conscious consumers who prioritize clean labels and functional ingredients. Another trend is the shift towards convenient formats like gummies and ready-to-drink beverages. Innovation targeting younger consumers who value transparency, ethical sourcing, and multi-functional supplements is also central. The expansion of omnichannel distribution strategies has made products more widely available, while commitments to sustainability and ethical sourcing are increasingly influencing purchasing decisions.

Competitive pricing strategies are being adopted to make supplements more accessible, especially in emerging markets and for cost-sensitive consumers. The growing adoption of e-commerce and personalized subscription models is also transforming how consumers purchase supplements. Finally, companies are implementing regional adaptation strategies to cater to diverse preferences and regulatory environments across different countries.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 751 million |

| Revenue Forecast for 2035 | USD 1.1 billion |

| Growth Rate (CAGR) | 3.3% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Ingredient, form, distribution channel, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, South America, MEA |

| Country Scope | U.S., Canada, Germany, UK, France, China, India, Japan, Australia, Brazil, UAE, Saudi Arabia |

| Key Companies Analyzed | Nestle Health Science, Herbalife Nutrition, Nature Made, Thorne Research, GNC Live Well, Pure Synergy, Nutricost, Mary Ruth Organics, Better Your Health, Centrum, Nature’s Way, Futurebiotics, NativePath, Dr. Emil Nutrition |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Ingredient

- Ashwagandha

- St. John’s Wort

- Ginseng

- Omega-3 Fatty Acids

- B Vitamins

- Magnesium

- L-Theanine

- 5-HTP

- SAM-e

- Rhodiola

- By Form

- Capsules

- Tablets

- Powders

- Gummies

- Liquids

- Effervescent Tablets

- By Distribution Channel

- Pharmacies & Drug Stores

- Supermarkets & Hypermarkets

- Health & Specialty Stores

- Online Retail

- Direct Sales

- By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia

- Oceania

- Middle East & Africa

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Key Success Factors

- Market Assessment – 2025 and 2035

- Historical Market Size (2020-2024) and Forecast (2025-2035)

- Pricing Analysis

- Market Background

- Market Analysis by Ingredient

- Ashwagandha

- St. John’s Wort

- Ginseng

- Omega-3 Fatty Acids

- B Vitamins

- Magnesium

- L-Theanine

- 5-HTP

- SAM-e

- Rhodiola

- Market Analysis by Form

- Capsules

- Tablets

- Powders

- Gummies

- Liquids

- Effervescent Tablets

- Market Analysis by Distribution Channel

- Pharmacies & Drug Stores

- Supermarkets & Hypermarkets

- Health & Specialty Stores

- Online Retail

- Direct Sales

- Market Analysis by Region

- North America

- Latin America

- Europe

- East Asia

- South Asia

- Oceania

- Middle East & Africa

- North America Market Analysis

- Europe Market Analysis

- Asia Market Analysis

- Latin America Market Analysis

- Middle East & Africa Market Analysis

- Market Structure Analysis

- Competition Landscape

- Company Profiles

- Research Methodology

- Assumptions