Comprehensive Analysis of the Extra Neutral Alcohol (ENA) Market: Growth Trajectories, Application Diversification, and Future Outlook (2025-2035)

Overview:

The global Extra Neutral Alcohol (ENA) market is anticipated to achieve a valuation of USD 10.72 billion in 2025. It is forecast to grow at a compound annual growth rate (CAGR) of 6.1% between 2025 and 2035, reaching an estimated market value of USD 19.38 billion by the end of the forecast period. The market demonstrated a CAGR of 5.7% from 2020 to 2025.

Extra Neutral Alcohol, also known as 96% pure ethanol, is a preferred base spirit in the production of various alcoholic beverages such as vodka, gin, rum, liqueurs, and aperitifs. The increasing worldwide consumption of alcoholic drinks is a significant driver for manufacturers to explore and develop new types of alcohol, thereby boosting demand for ENA.

Beyond alcoholic drinks, ENA is also used as a food-grade solvent in the processing of certain food products, including chocolate confections. Its efficacy in diffusing flavors and colorants makes it a valuable ingredient in the food sector. Leading spirit companies are keen on entering emerging markets, such as India, where the potential for rapid market expansion is substantial.

Concerns about environmental sustainability are influencing government policies, particularly in nations like India. The Indian government has actively promoted sustainable and green energy initiatives, including the blending of ethanol with gasoline. In 2023, a 20% ethanol blend was mandated, representing a significant step towards reducing reliance on fossil fuels and mitigating greenhouse gas emissions.

Due to its inherent antibacterial and preservative properties, ENA finds extensive use in various personal care products like lotions, shampoos, hairsprays, deodorants, and perfumes. The substance acts as an effective carrier for both fragrance and flavor compounds in these applications, driving demand within the personal care sector.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 10.72 Billion |

| Projected Industry Value (2035F) | USD 19.38 Billion |

| Value-based CAGR (2025 to 2035) | 6.1% |

Manufacturers are leveraging advanced technologies to ensure their ENA products meet stringent quality standards, particularly for pharmaceutical production. Market participants are also diligently adhering to the high requirements set by major producers of personal hygiene products, ensuring suitability for diverse end-use applications.

The market is experiencing growth driven by sustainability programs. Organic and sustainable Extra Neutral Alcohol is gaining traction, offering potential revenue streams. Environmentally aware consumers are increasingly seeking products with minimal environmental impact. Producers of ENA are capitalizing on this trend by focusing on sustainably sourced grains and eco-friendly production methods, appealing to this consumer base.

Companies are targeting health-conscious consumers who perceive organic ENA as a purer option. They are also positioning their products for premium spirits manufacturers seeking long-term benefits, aligning with the growing demand for high-quality ingredients. Furthermore, the expansion of the bar scene is fueling the need for organic options in cocktail preparation, which ENA producers are addressing.

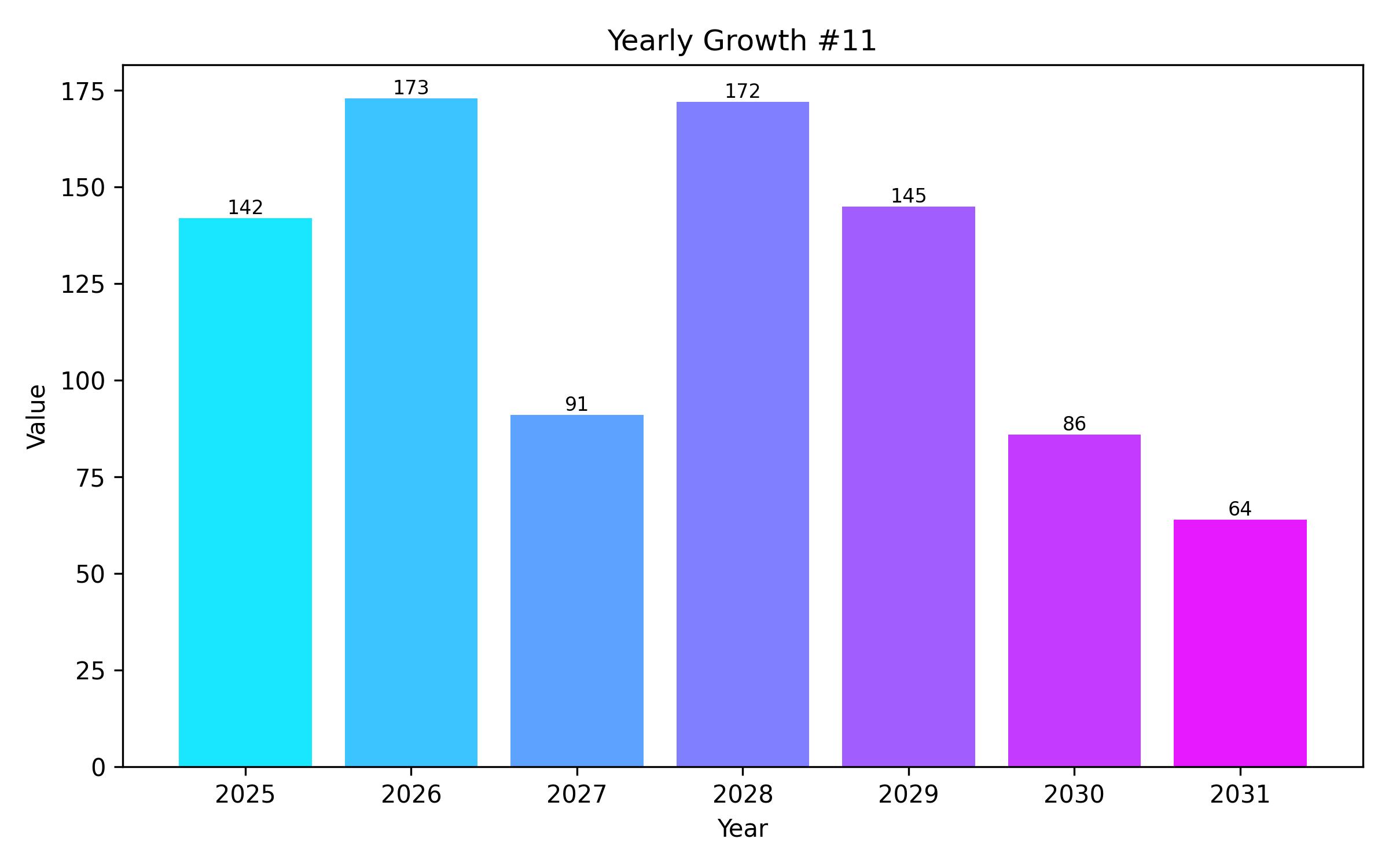

Between 2020 and 2024, the market’s sales growth rate was 5.7%. The market is projected to sustain a growth trajectory with a CAGR of 6.1% over the forecast period from 2025 to 2035. The demand for ENA is directly linked to the production of popular alcoholic beverages such as vodka, gin, and liqueurs, where it serves as the foundational spirit. The historical consumption trend of alcoholic beverages has consistently driven ENA sales, with temporary disruptions primarily observed during the global pandemic when various economic activities were curtailed.

Beyond traditional spirits, ENA is finding applications in the cosmetics and pharmaceutical industries. The expansion of these sectors has introduced new avenues for ENA utilization, contributing to industry revenue beyond potable alcohol uses. Craft distillers, emphasizing premium ingredients, have also carved out a market segment for high-quality ENA. Producers are adopting innovative fermentation methods to meet this demand for premium ENA and explore new product formulations.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 10.72 billion |

| Revenue Forecast for 2035 | USD 19.38 billion |

| Growth Rate (CAGR) | 6.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Raw Material, Application, and Region |

| Regional Scope | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, France, Italy, China, India, Japan, South Korea, Brazil, Argentina, UAE, Saudi Arabia, South Africa |

| Key Companies Analyzed | Illovo Sugar Limited, USA Distillers LLC, NCP Alcohols (Pty) Ltd, Agro Chemical and Food Company Limited, Mumias Sugar Company Limited, Sasol Solvents (Pty) Ltd, Swift Chemicals Ltd, Enterprise Ethanol (Pty) Ltd, Tag Solvent Products Pvt Ltd, RadicoKhaitan Limited, BCL Industries Ltd |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Raw Material

- Grain-based

- Molasses-based

- Sugarcane-based

- Other Sources

- By Application

- Potable Alcohol

- Industrial Solvent

- Pharmaceuticals

- Cosmetics & Personal Care

- Food & Beverages (Flavors & Fragrances)

- By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive snapshot

- Market Overview

- Key Market Trends

- Key Success Factors

- Market Demand Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market – Pricing Analysis

- Market Demand (in Value or Size in USD Billion) Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market Background

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Raw Material

- Grain-based

- Molasses-based

- Sugarcane-based

- Other Sources

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Potable Alcohol

- Industrial Solvent

- Pharmaceuticals

- Cosmetics & Personal Care

- Food & Beverages (Flavors & Fragrances)

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- South Asia & Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Region wise Market Analysis 2025 & 2035

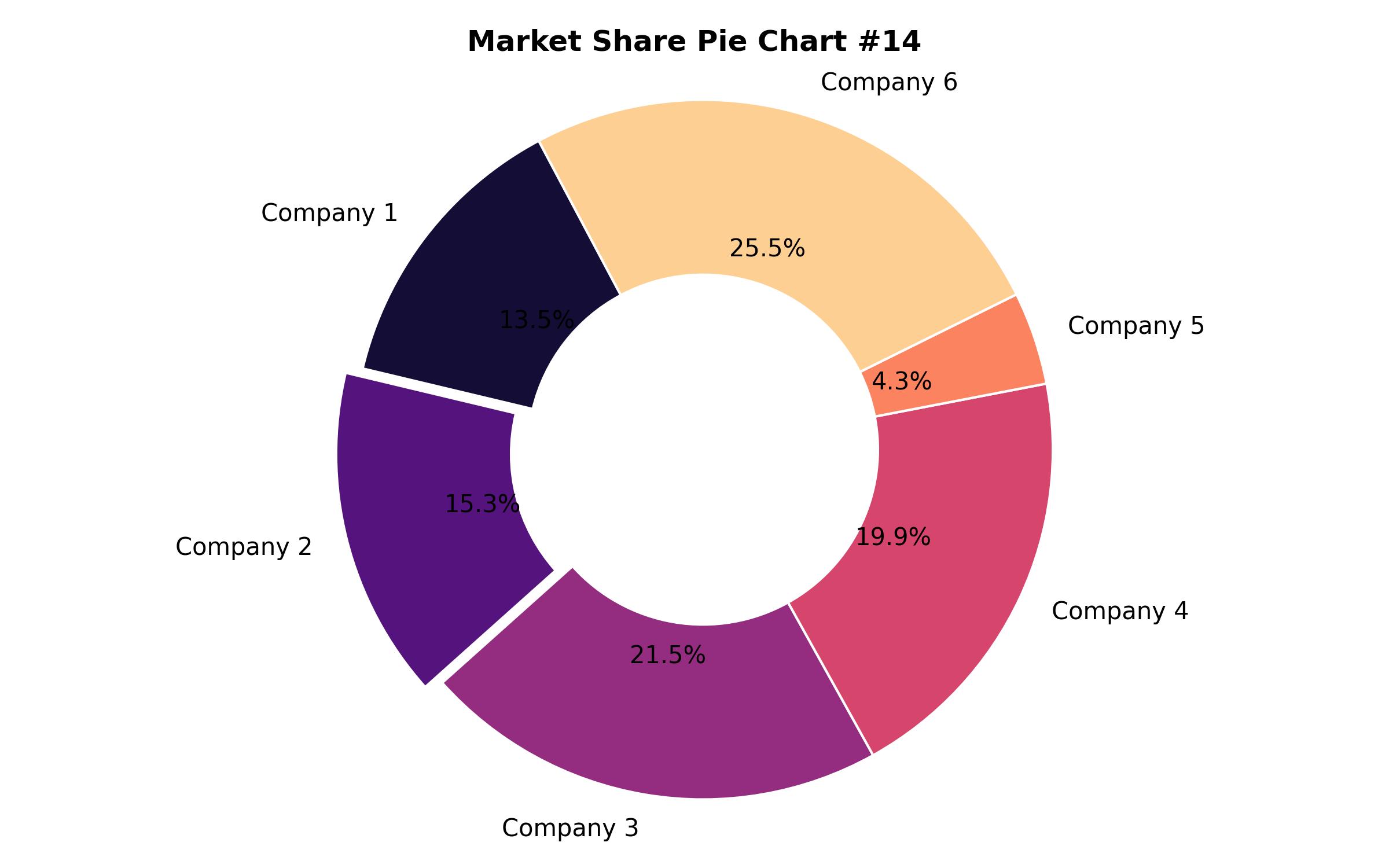

- Market Structure Analysis

- Competition Analysis

- Illovo Sugar Limited

- USA Distillers LLC

- NCP Alcohols (Pty) Ltd

- Agro Chemical and Food Company Limited

- Mumias Sugar Company Limited

- Sasol Solvents (Pty) Ltd

- Swift Chemicals Ltd

- Enterprise Ethanol (Pty) Ltd

- Assumptions and Acronyms Used

- Research Methodology