Comprehensive Market Study of Resistant Starch: Analyzing Product Types, Sources, Applications, and Regional Dynamics Through 2035

Overview:

The global resistant starch market is experiencing steady expansion, driven by growing consumer awareness of digestive health and the demand for functional ingredients. Estimated at USD 7.0 billion in 2025, the market is projected to advance at a compound annual growth rate (CAGR) of 7.9% over the forecast period from 2025 to 2035. This trajectory is anticipated to push the market value to USD 15.1 billion by the conclusion of 2035.

Resistant starch, a complex carbohydrate that evades digestion in the small intestine, functions similarly to dietary fiber. This unique property makes it highly desirable for formulations targeting gut health, weight management, glycemic control, and promoting feelings of fullness. With the increasing global prevalence of metabolic disorders such as type 2 diabetes and obesity, consumers are actively seeking functional ingredients like resistant starch to enhance their overall health and well-being.

The incorporation of resistant starch into various food applications, including baked goods, breakfast cereals, pasta, snack bars, and dairy alternatives, continues to rise. This trend is fueled by the demand for low-glycemic index and clean-label options. Naturally sourced resistant starch types, such as high-amylose maize and retrograded starch (RS2 and RS3), are gaining traction due to their natural origins and stability during processing.

Leading market participants, including Ingredion Incorporated, Cargill, and Tate & Lyle, are intensifying their research and development efforts. They are leveraging the textural benefits, flavor-masking capabilities, and ease of formulation offered by resistant starch. The market for prebiotic and gut microbiome-supporting products is also expanding, positioning resistant starch as a key active ingredient. This strategic product development, coupled with growth in the functional foods sector, is building a strong foundation for sustained market expansion.

| Attributes | Description |

|---|---|

| Estimated Global Resistant Starch Industry Size (2025E) | USD 7.0 billion |

| Projected Global Resistant Starch Industry Value (2035F) | USD 15.1 billion |

| Value-based CAGR (2025 to 2035) | 7.9% |

Furthermore, the growing emphasis on sustainable and plant-based food ingredients presents a significant opportunity for resistant starch, particularly in catering to demand from flexitarian and vegan consumers. As developing economies experience shifts in dietary practices influenced by global health trends, the future for resistant starch appears promising through 2035, offering an accessible and nutritious dietary component.

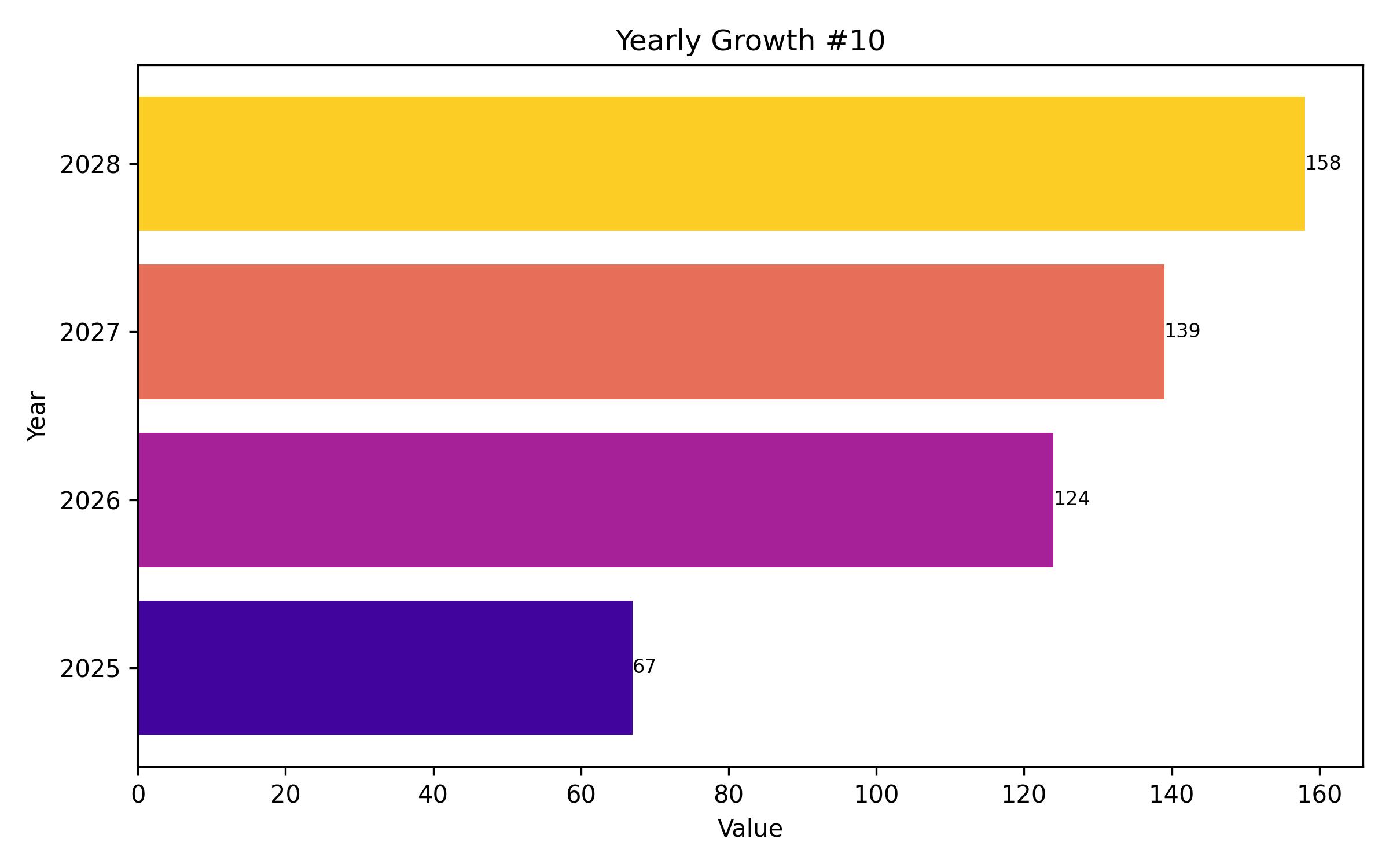

A semi-annual market analysis indicates a consistent upward trend in growth. The Compound Annual Growth Rate (CAGR) for the first half of 2024 to 2034 was 7.6%, increasing slightly to 7.8% in the second half. This positive momentum continued into the 2025 to 2035 period, with the CAGR reaching 7.9% in the first half and 8.0% in the second half. This steady improvement, marked by a 0.4% increase in CAGR across the period, reflects strengthening market conditions, particularly within the functional food and fiber segments.

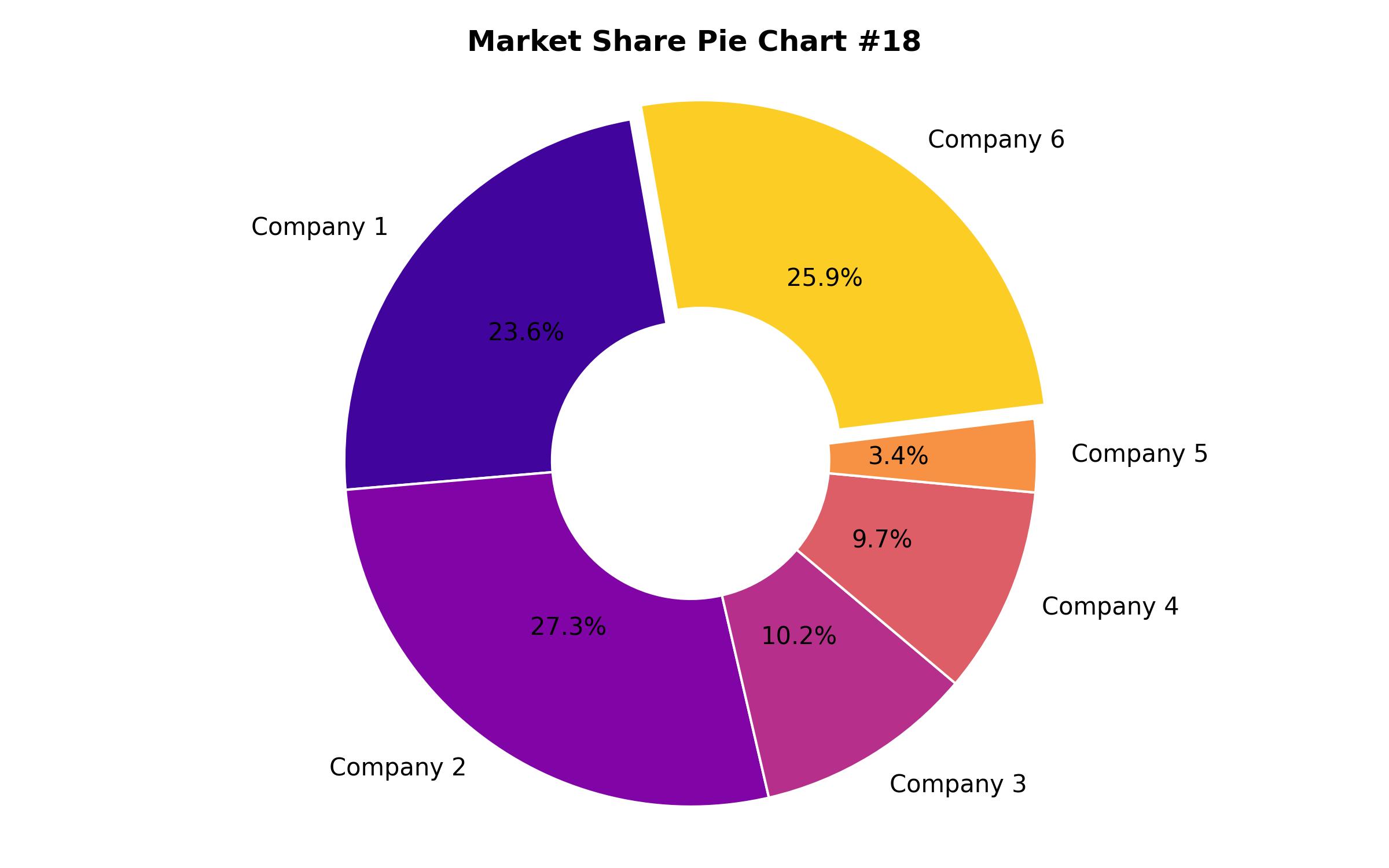

The market exhibits varied concentration levels among participants. Tier 1 comprises large, established companies known for their extensive starch processing capabilities, recognized ingredient brands, and strong relationships within the food and beverage industry globally. Ingredion Incorporated holds a prominent position, notably with its Hi-Maize brand, which has a strong presence in North American, European, and Asian baking, cereal, and nutrition markets.

These top-tier players benefit from sophisticated formulation expertise and scientific understanding, making them preferred suppliers for multinational corporations focused on fiber and health fortification. Cargill, Inc., another major Tier 1 entity, offers resistant starch solutions as part of its broad portfolio of starch derivatives, leveraging its extensive blending capacity and emphasizing digestive health benefits. These companies maintain their market leadership through robust supply chains, adherence to regulatory requirements, and ongoing investment in research and development, particularly in both developed and emerging markets.

Tier 2 includes companies with significant reach but potentially more localized or niche market penetration and relatively lower sales volumes. These firms often specialize in certain food ingredients, highlighting clean-label attributes and forming strategic alliances to strengthen their market standing. MGP Ingredients, for instance, provides a range of wheat-based resistant starches tailored for the bakery, snack, and protein product categories.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 7.0 billion |

| Revenue Forecast for 20 thirtyfive | USD 15.1 billion |

| Growth Rate (CAGR) | 7.9% from 2025 to 20 thirtyfive |

| Base Year for Estimation | 2024 |

| Historical Data | 2018 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Product Type, Source, End Use, and Region |

| Regional Scope | North America, Latin America, Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Country Scope | U.S., Canada, Mexico, Germany, U.K., China, India, Japan, Brazil, Australia, South Africa |

| Key Companies Analyzed | Cargill, Incorporated, Ingredion Incorporated, MGP Ingredients, Tate & Lyle Plc, Arcadia Biosciences, Roquette Frères, Lodaat Pharmaceuticals, Emsland Group, Penford Corporation, MSP Starch Products Inc. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Product Type

- RS1

- RS2

- RS3

- RS4

- RS5

- By Source

- Grains

- Potatoes

- Legumes

- Fruits

- By End Use

- Bakery Products

- Cereal & Confectionery

- Processed Foods

- Dietary Supplements

- Beverages

- Animal Feed

- Other End Use

- By Region

- North America

- Latin America

- Europe

- South Asia & Pacific

- East Asia

- Middle East & Africa

Table of Content

- Executive Summary

- Market Overview

- Key Market Dynamics

- Global Resistant Starch Market Analysis 2018 – 2023 and Forecast 2025 – 2035

- Market Volume Analysis 2018 – 2023 and Forecast 2025 – 2035

- Pricing Analysis

- Key Trends and Opportunities

- Market Background

- Global Resistant Starch Market Analysis 2018-2023 and Forecast 2025-2035, By Product Type

- Introduction

- Product Type Value Share Analysis 2025-2035

- RS1

- RS2

- RS3

- RS4

- RS5

- Global Resistant Starch Market Analysis 2018-2023 and Forecast 2025-2035, By Source

- Introduction

- Source Value Share Analysis 2025-2035

- Grains

- Potatoes

- Legumes

- Fruits

- Global Resistant Starch Market Analysis 2018-2023 and Forecast 2025-2035, By End Use

- Introduction

- End Use Value Share Analysis 2025-2035

- Bakery Products

- Cereal & Confectionery

- Processed Foods

- Dietary Supplements

- Beverages

- Animal Feed

- Other End Use

- Global Resistant Starch Market Analysis 2018-2023 and Forecast 2025-2035, By Region

- Introduction

- Region Value Share Analysis 2025-2035

- North America

- Latin America

- Europe

- South Asia & Pacific

- East Asia

- Middle East & Africa

- North America Resistant Starch Market Analysis 2018-2023 and Forecast 2025-2035

- Latin America Resistant Starch Market Analysis 2018-2023 and Forecast 2025-2035

- Europe Resistant Starch Market Analysis 2018-2023 and Forecast 2025-2035

- South Asia & Pacific Resistant Starch Market Analysis 2018-2023 and Forecast 2025-2035

- East Asia Resistant Starch Market Analysis 2018-2023 and Forecast 2025-2035

- Middle East & Africa Resistant Starch Market Analysis 2018-2023 and Forecast 2025-2035

- Market Structure Analysis

- Competitive Landscape

- Competitive Dashboard

- Company Profiles

- Assumptions and Acronyms

- Research Methodology